Can’t Afford Today’s Rates? Here’s What You Can Do

| July 18 2025

| Published by MSJ Mortgage

Buying a home has never felt more challenging than it does in today’s high-rate environment. For many would-be buyers, those headlines about soaring mortgage rates translate to real anxiety about monthly payments and overall affordability. It’s easy to feel like your dream of homeownership has been put on hold indefinitely.

But here’s the good news: you have options.

At Mission San Jose Mortgage, we believe that understanding those options is the first step toward making smart, confident choices even in a tough market. From creative financing tools to negotiation strategies that really work, there are proven ways to lower your monthly payment or make buying more feasible right now.

In this guide, we’ll break down practical solutions you can use today to beat high rates and get into the home you want without breaking your budget. Let’s dive in.

Negotiate a Temporary Rate Buydown

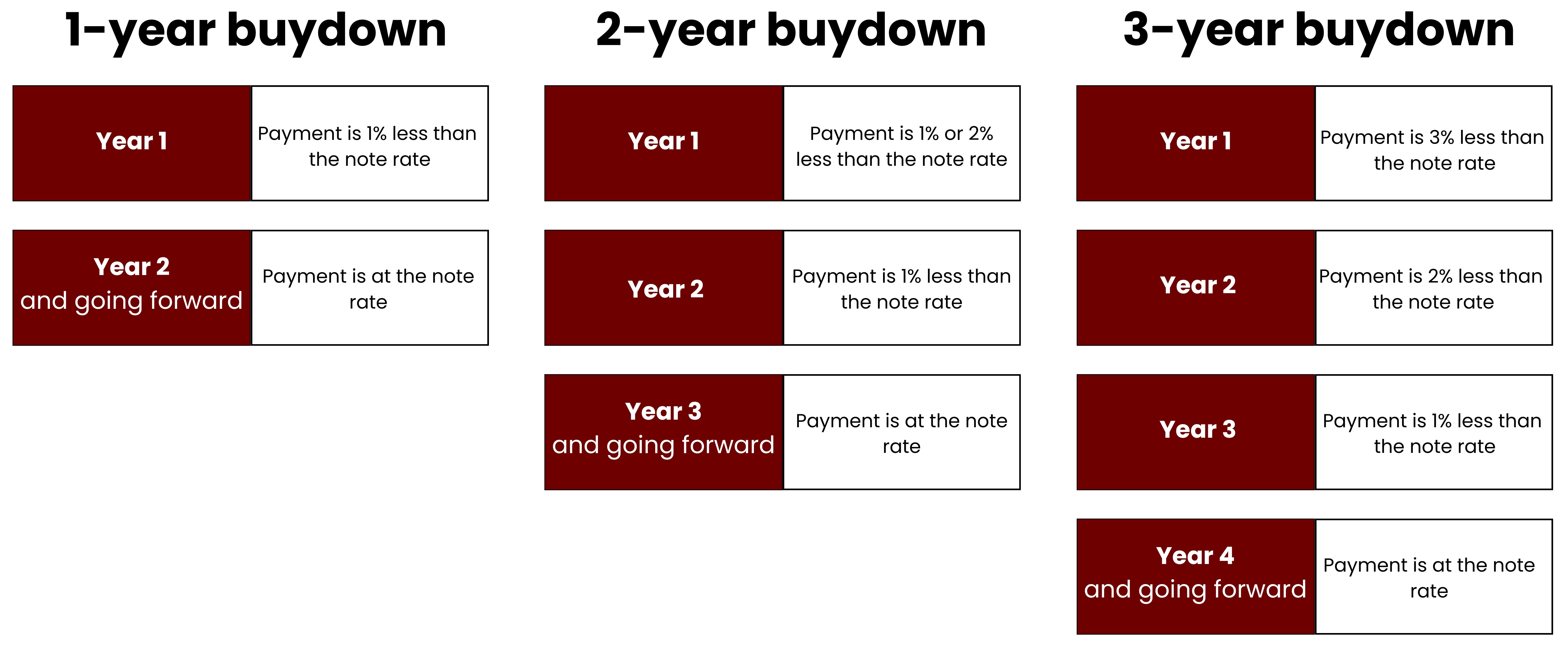

A temporary rate buydown is a powerful way to make homeownership more affordable, especially in today’s high-rate environment. With this strategy, you or your Realtor can negotiate with the seller (or builder) to reduce your mortgage interest rate for the first one to three years of the loan. Popular formats include 3-2-1, 2-1, and 1-0 buydowns, where the rate steps up gradually each year. This approach helps buyers “ease in” to full payments by offering significantly lower monthly costs at the start, an advantage when you’re also budgeting for a down payment, closing costs, and moving expenses. Sellers benefit too, since offering a buydown can make their home more appealing without lowering the list price.

Consider an Adjustable-Rate Mortgage (ARM)

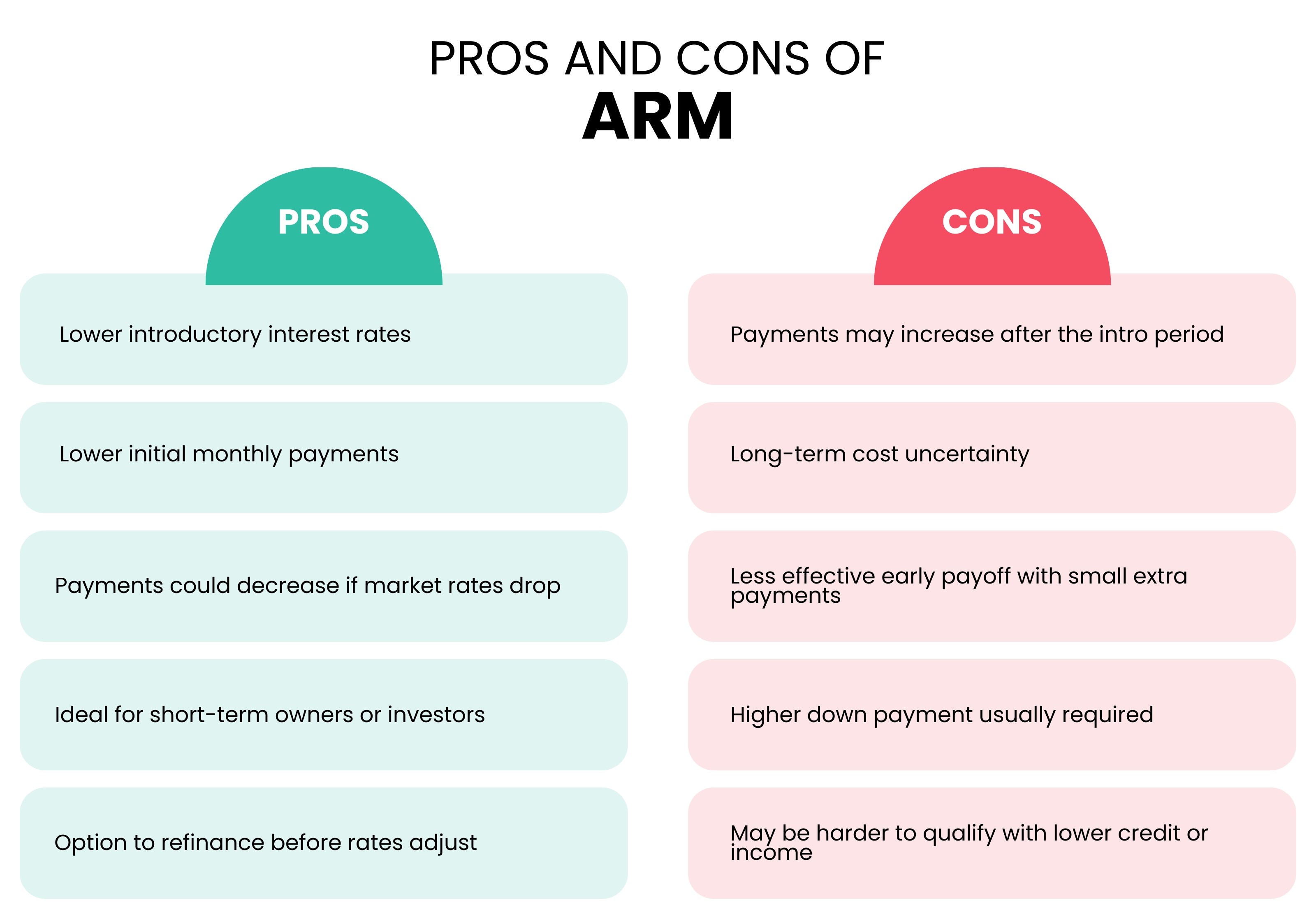

If you’re looking for lower monthly payments upfront, an Adjustable-Rate Mortgage (ARM) might be worth exploring. ARMs offer a low fixed interest rate for an initial period typically 5, 7, or 10 years after which the rate adjusts periodically based on market conditions. This means your payments can rise or fall over time. For buyers who plan to sell or refinance before the adjustment period kicks in, ARMs can offer significant savings in the early years of the loan. However, it’s important to weigh the risks: if rates increase, your payments could jump, potentially straining your budget.

Pay Discount Points to Buy Down the Rate

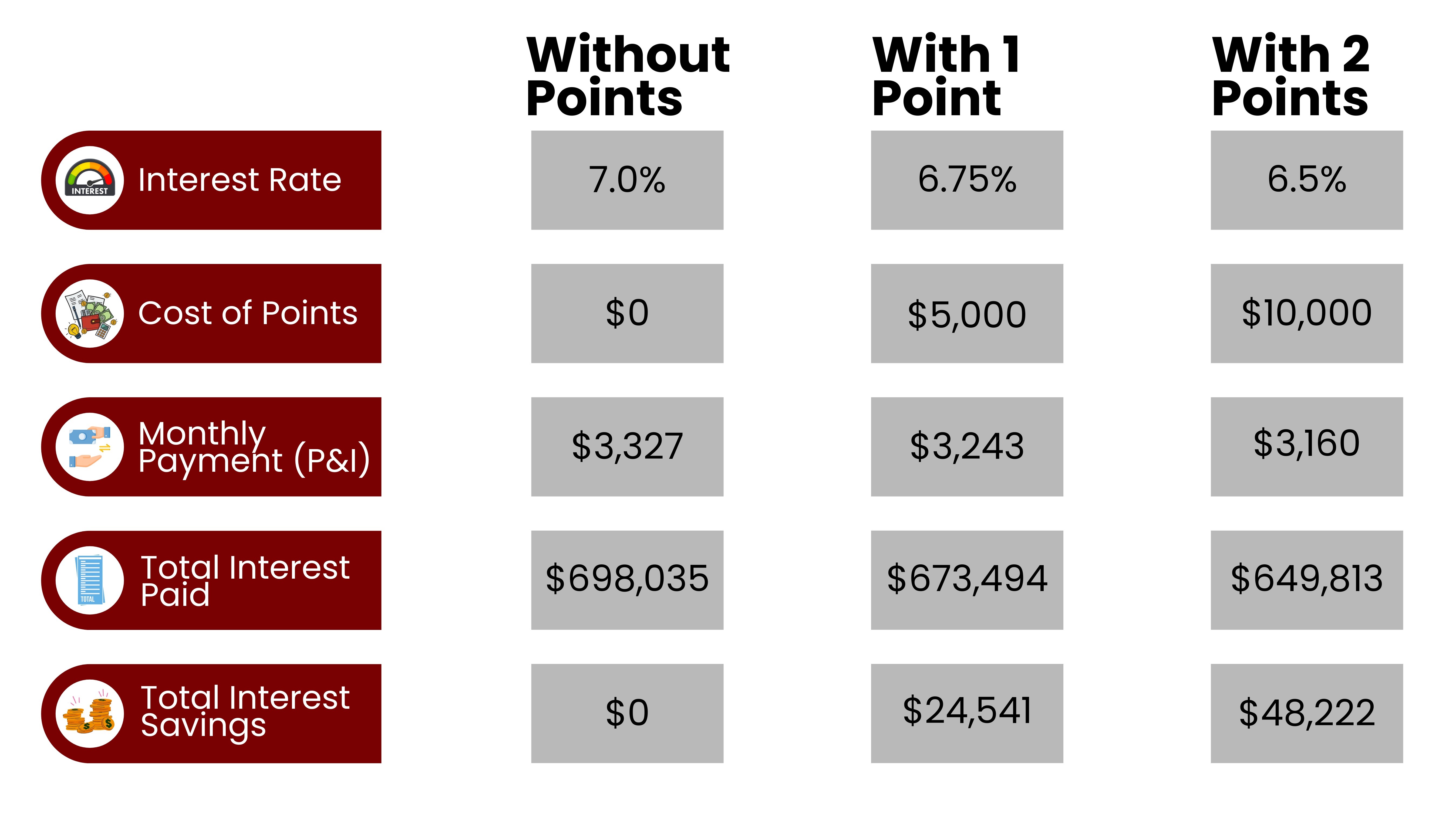

Another way to lower your mortgage payment is by paying discount points upfront to permanently reduce your interest rate. Typically, one point equals 1% of your loan amount and lowers your rate by about 0.25%, though the exact cost and benefit can vary by lender. For example, buying down the rate from 7% to 6.75% might cost 1.5 points. While this strategy can lead to meaningful monthly savings, it’s important to consider how long you plan to stay in the home. You’ll want to calculate your “break-even” point the number of months it takes for the lower payments to offset the upfront cost. If you expect to sell or refinance before then, buying points might not be worth it.

If you can afford to pay for discount points in addition to your down payment and closing costs, you can reduce your monthly mortgage payments and potentially save money overall. The key is staying in the home long enough to recoup the prepaid interest. If you sell the home after only a few years, refinance the mortgage, or pay it off early, buying discount points could actually cost you more.

Here’s an example of how discount points can reduce costs on a $500,000, 30-year fixed-rate mortgage:

In this example, paying two points ($10,000 upfront) lowers the monthly payment by $167 and saves over $48,000 in interest over 30 years. But to realize the full savings, the borrower must keep the loan for its entire term without refinancing.

Increase Your Down Payment

Increasing your down payment is one of the most effective ways to reduce your monthly mortgage payment and overall borrowing costs. While many buyers aim for 20% down to avoid private mortgage insurance (PMI), even a slightly larger down payment can lower your interest rate, reduce your loan-to-value ratio, and save you tens of thousands of dollars over the life of the loan. Saving up for a bigger down payment can feel daunting given today’s high home prices, but with careful planning like setting clear savings goals, researching local market prices, trimming expenses, and exploring high-yield savings options you can make it more achievable. You might also consider creative ways to fund it, such as using monetary gifts from family, applying for down payment assistance grants, or selling assets you no longer need.

Explore First-Time Buyer and Government Programs

Buying your first home can feel daunting, but there are many first-time buyer and government programs designed to make it more achievable. These programs often offer lower down payment requirements, grants for closing costs, or special loan terms to help reduce the upfront financial burden. Options include FHA loans with down payments as low as 3.5%, VA loans with no down payment for eligible veterans and active-duty service members, and USDA loans for rural properties with up to 100% financing. Many states and local governments also offer assistance programs and grants, while the IRS allows penalty-free early IRA withdrawals of up to $10,000 for first-time homebuyers. By researching and tapping into these resources, you can significantly lower your costs and ease your path to homeownership.

Negotiate with Sellers for Credits or Price Reduction

Negotiating with the seller for credits or a price reduction can be a powerful way to make buying a home more affordable, especially in a slower market. Instead of cutting the listing price by tens of thousands of dollars, sellers may be willing to offer credits toward your closing costs or pay for a temporary buydown of your mortgage rate. This can cost the seller less overall while making the home more attractive to buyers by lowering monthly payments in the early years of the loan. It’s a win-win strategy: sellers get more offers without sacrificing as much on price, and buyers benefit from improved upfront affordability. (See the example illustration below for how this can work in practice.)

This example shows how both parties can benefit: the seller retains more value from the sale, while the buyer enjoys lower initial payments.

Improve Your Credit Before Applying

Improving your credit score before applying for a mortgage can help you qualify for better rates and save thousands over the life of your loan. Here are some practical steps to strengthen your credit profile:

● Make on-time payments: Your payment history is the biggest factor in your score, so always pay at least the minimum by the due date.

● Pay down balances: Aim to keep your credit utilization below 30% by paying off high credit card balances.

● DKeep old accounts open: A longer credit history helps your score. Keep older cards active with small, regular purchases.

● Maintain a healthy credit mix Responsibly manage both credit cards and installment loans to show you can handle different types of debt.

● Limit new credit applications Avoid too many hard inquiries before applying for a mortgage to prevent temporary score drops.

By taking these steps, you’ll be better positioned to secure an affordable home loan with favorable terms.

Work with a Broker to Shop Multiple Lenders

Working with a mortgage broker can be a smart way to explore a wide range of loan options without doing all the legwork yourself. Brokers have access to multiple lenders and loan programs, which means they can help you compare rates, fees, and terms to find the mortgage that best suits your needs and budget. A good broker can also help you navigate complex requirements, spot hidden costs, and negotiate better terms on your behalf. By leveraging their relationships and expertise, you may save time, reduce stress, and ultimately secure a more affordable loan than you might find on your own.

Final Thought

Buying a home is one of the biggest financial decisions you’ll ever make, and it pays to be strategic and well-informed at every step. Whether you’re boosting your credit score, increasing your down payment, negotiating with sellers, or shopping multiple lenders through a broker, each move can make a meaningful difference in what you pay over the life of your loan. Take the time to research your options, plan ahead, and make choices that align with your long-term goals. By approaching the process thoughtfully, you’ll set yourself up for greater affordability, stability, and peace of mind in your new home.