The Ultimate First-Time Homebuyer’s Guide by Mission San Jose Mortgage

| May 02 2025

| Published by MSJ Mortgage

Buying your first home is one of the most exciting and sometimes overwhelming milestones in life. It’s a big financial commitment, but with the right guidance, you can navigate the process smoothly and confidently. This guide is designed to walk you through every step, from figuring out if you’re ready to buy all the way to closing on your dream home. We’ll break down complex terms into simple, easy-to-understand explanations, so you can feel empowered to make smart decisions. Whether you’re just starting to think about homeownership or you’re ready to take the plunge, this guide will give you the knowledge you need to succeed.

Are You Really Ready to Buy a House?

Buying a house is a big deal! It’s a lot of money, and it’s a big responsibility. Before you decide, let’s check if you’re really ready.

● Do You Plan to Stay in One Place for a While?

If you plan to live in the same place for at least five years, buying could be a good choice. But if you might move soon, renting could be better.

● Is Your Job Steady?

Lenders want to see if you have a reliable job or income. If you’re planning to change jobs or start a business soon, it might be better to wait until things are more stable

● Do You Have Enough Money Saved?

Buying a house isn’t just about the down payment. You’ll also need extra money for closing costs, moving, and unexpected repairs. It’s a good idea to have enough money saved to cover three to six months of bills.

● Are You Ready to Fix Things?

When you own a house, you have to fix things when they break like toilets or leaky roofs. If you’re okay with that, you’re ready!

● Your Credit Score Good?

Your credit score shows how well you handle money. A higher score helps you get a loan with a better interest rate. If your score isn’t great, it’s a good idea to fix it before buying.

● Do You Know What Kind of Loan You Need?

There are different types of home loans. Some keep the same interest rate forever (fixed-rate), and others change (adjustable-rate). It’s good to know what loan works best for you.

How Much House Can You Afford?

Before you start looking for a home, it’s important to know how much you can realistically spend. A simple way to figure this out is to compare your monthly income with what a home will cost you each month including the mortgage, property taxes, homeowners insurance, and other related expenses.

A good rule of thumb is to spend no more than 28% of your monthly income on housing costs. For example, if you make $5,000 a month, try to keep your total housing expenses under $1,400.

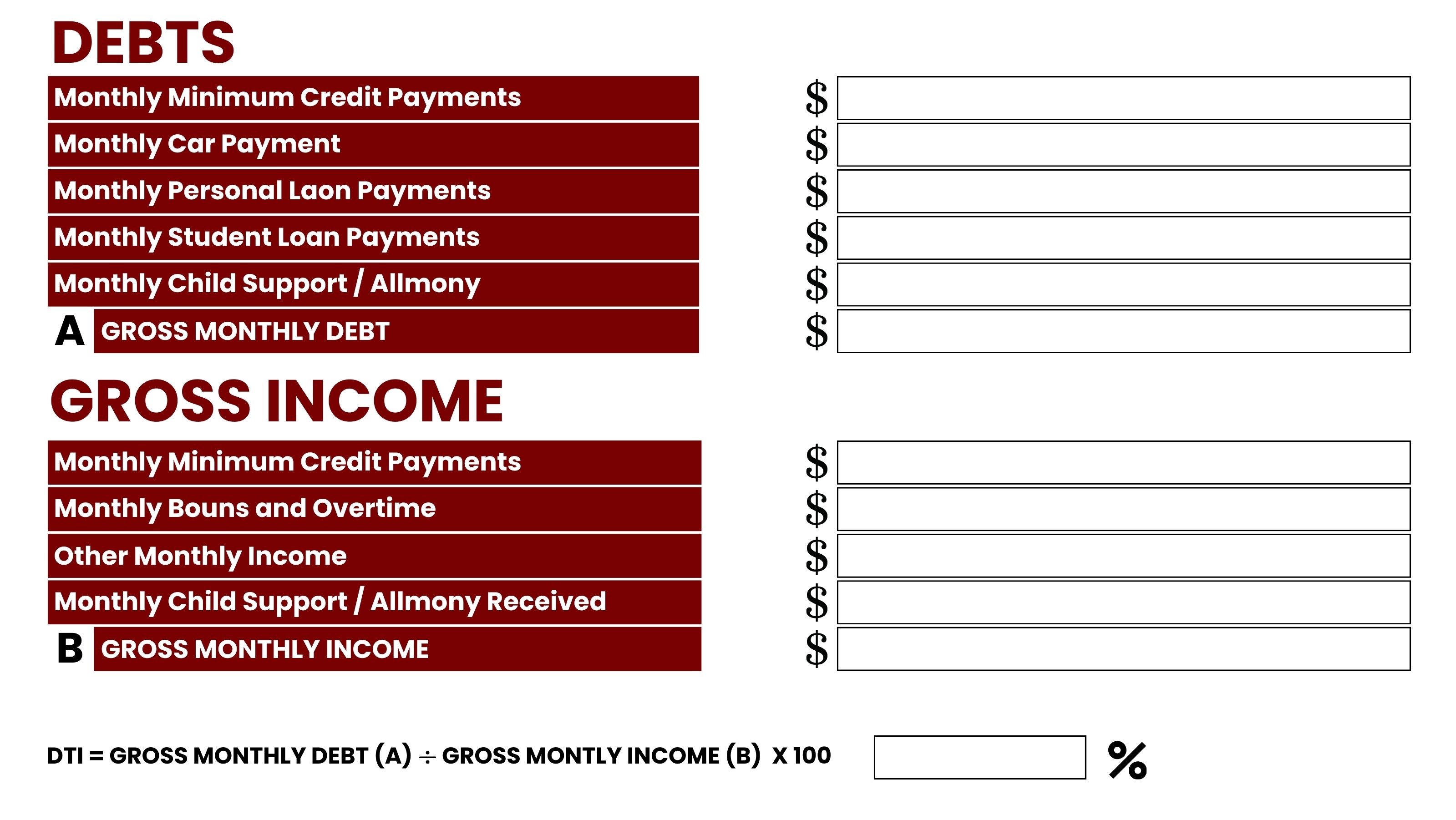

But it’s not always that simple. Lenders look at more than just your income; they also consider your debt-to-income ratio (DTI). This is the percentage of your monthly income that goes toward paying off debts, like car loans, student loans, or credit cards. Most lenders prefer your DTI to be under 43%, including the mortgage.

Let’s say you make $2,000 a month and pay $500 toward debts. That’s a DTI of 25%, which most lenders would consider manageable.

Other things like your credit score, down payment amount, and even your monthly spending habits also play a role. The lower your debt and the stronger your credit, the more likely you are to qualify for a better loan.

So, before house hunting, make sure you know your monthly income, calculate your debts, and understand how much of that income can safely go toward a home. That way, you’ll avoid overbuying and stay financially comfortable in your new place.

Why Choose an FHA Loan?

Key Factors Lenders Consider:

● Credit Score: Your financial report card that helps lenders determine your reliability and what interest rate you’ll get. A higher score can lead to better loan terms.

● Employment History: Lenders prefer borrowers who have been with the same employer or in the same line of work for at least two years.

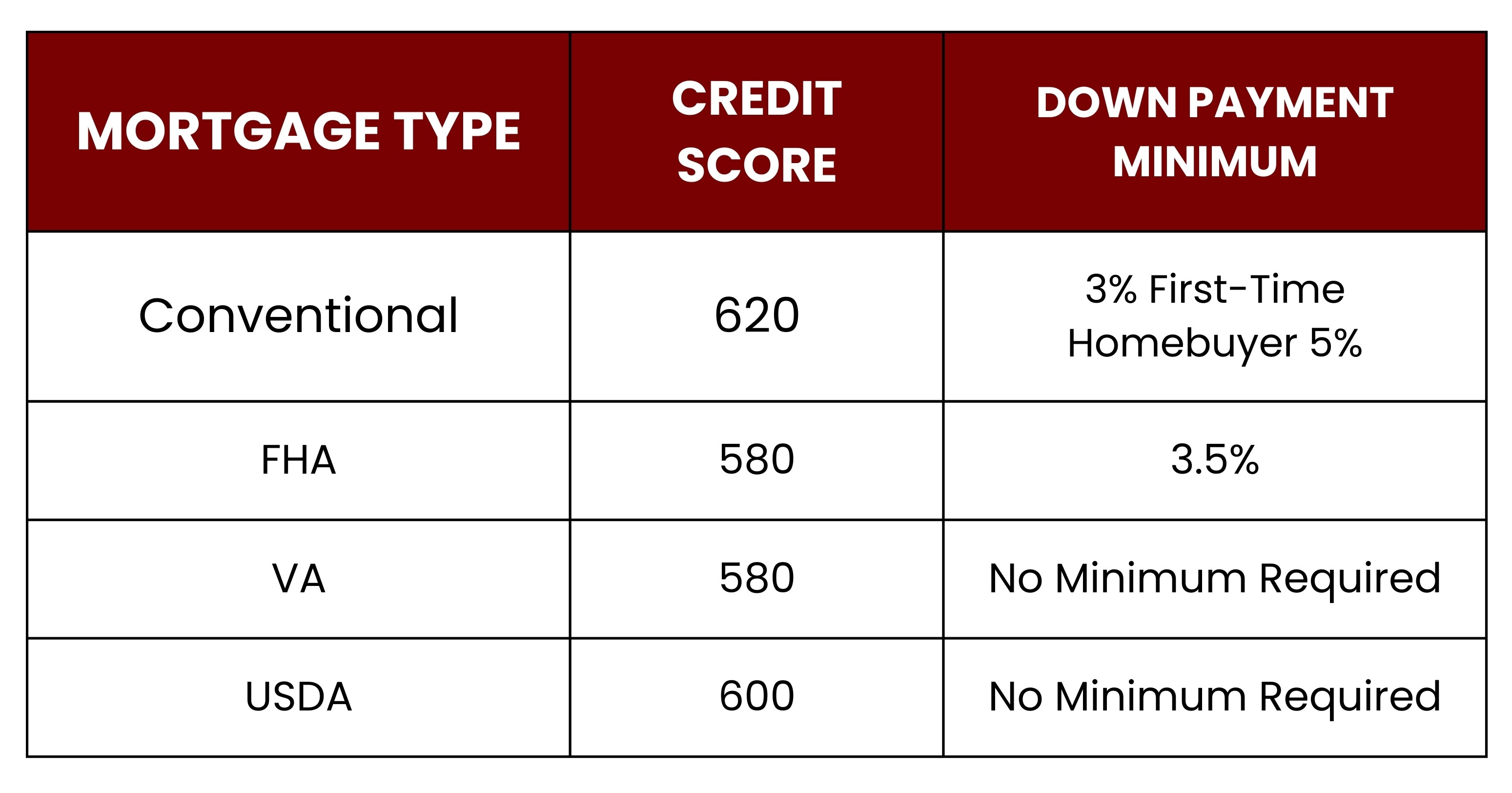

● Down Payment: Many loans offer low down payments, and some even allow 0% down, depending on the type of loan.

Knowing these factors and how they relate to your financial situation will help you be better prepared when applying for a mortgage.

Save for a Down Payment and Closing Costs

When you buy a house, you usually need to save money for two things: the down payment and closing costs.

What is a Down Payment?

A down payment is money you pay upfront to help buy the house. It’s like your first big payment before you start paying monthly.

What are Closing Costs?

Closing costs are extra fees you pay when you finish buying the house. These fees are paid when the house deal is done.

How Much Money Do You Need?

The amount you need to save depends on the type of loan you get. Here’s a quick look at the minimum down payment required:

Some places have special rules. For example, in big cities like New York, you might need to save 30% or more because houses cost more.

Down Payment Help

There are programs that can help with down payments, especially for first-time homebuyers. These programs give you money to help with your down payment and closing costs, and they can be from the government or special groups that want to help people buy their first home.

Are you getting gift money?

Here's What You Need to Know

Sometimes, your family might want to help you buy a home by giving you some money as a gift. That’s totally okay but the lender needs to know a few things to make sure everything’s done the right way.

Understanding Your Credit Score and What Affects It

A credit score is a number that shows how likely you are to repay debt, based on your credit history. It usually ranges from 300 to 850, with a higher number indicating better credit. A high credit score can help you get the best mortgage terms, while a low score might make it harder to get approved or result in less favorable loan terms.

How is Your Credit Score Calculated?

● Payment History: This looks at whether you’ve paid bills on time and how late any missed payments were. Consistent on-time payments help build a strong credit score.

● Amounts Owed: Lenders want to know how much of your available credit you’re using. Try to keep your credit utilization below 30%.

● Length of Credit History: The longer your credit history, the better. A long track record of responsible credit use helps your score.

● New Credit: If you open many new accounts in a short time, it can lower your score.

● Types of Credit: A mix of different credit accounts, such as credit cards, auto loans, and mortgages, can help your score.

Lenders use your credit score when deciding whether to approve you for a mortgage loan and to determine the terms of that loan.

How Your Credit Score Affects Your Mortgage Rate

Your credit score impacts:

● Mortgage approval: Higher scores increase your chances of being approved.

● Interest rates: Lower scores often mean higher interest rates, which can cost you more over the life of the loan.

● Loan terms: Some loan programs require a minimum credit score to qualify.

How Credit Scores Affect Your Mortgage Loan Beyond Just Approval

Your credit score also impacts:

● Down payment: Lower scores may require a larger down payment.

● Private Mortgage Insurance (PMI): A low score might result in PMI, which adds to your monthly payment.

● Loan limits: Some loan programs have limits that may depend on your credit score.

Your credit score plays a significant role in the mortgage process. A higher score gives you access to better loan terms, lower interest rates, and less upfront cost, making it essential to understand how your score impacts your home buying process.

Homeownership and Student Loan Debt

Student loan debt significantly impacts homeownership, delaying or preventing many individuals from purchasing a home. Since 2005, homeownership among recent college graduates has decreased by 1.8% for every $1,000 of student loan debt. Over 50% of renters report that student loan debt is keeping them from buying a home, with 72% of student debt holders believing it will delay homeownership for several years.

Student loan debt not only makes it harder to save for a down payment but also negatively impacts debt-to-income ratios, reducing mortgage eligibility. First-time homebuyers with student loan debt spend, on average, 39% less on their homes than those without debt. Furthermore, individuals with student loans over $35,000 are 27% less likely to be homeowners.

Programs such as the Transforming Student Debt to Home Equity Act aim to ease this burden by offering financial assistance, relaxed qualification standards, and mortgage loans at below-market rates for eligible first-time buyers. However, student loan debt continues to be a major barrier, particularly for younger generations and those with lower incomes, delaying their journey to homeownership.

Can You Buy a Home with Student Loan Debt?

Yes you can! Here’s how to improve your chances:

● Pay on time Making loan payments on time helps your credit score.

● Lower your monthly payment Ask about repayment plans that reduce your student loan bill. This can improve your debt-to-income ratio.

● Consolidate your loans Combining loans might lower your interest rate and make payments more manageable.

● Pick the right mortgage Programs like FHA and VA loans offer flexible options for buyers with student debt.

Explore Your Mortgage Options

There are several mortgage options for homebuyers. Mission San Jose Mortgage, as a mortgage broker, connects you with lenders to help find the loan that fits your financial situation best.

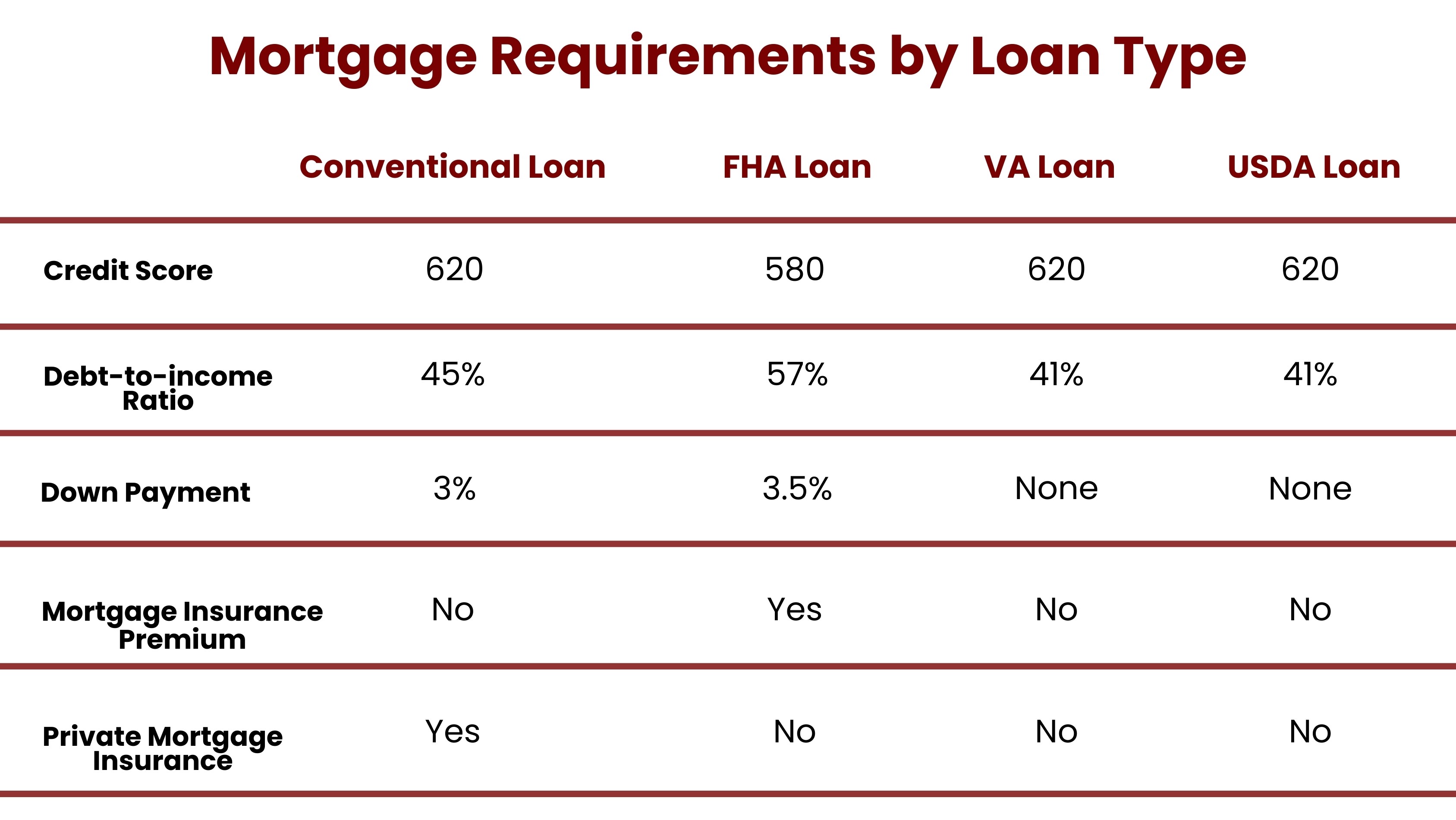

● Conventional Loans: Most common type; not government-backed. Good for borrowers with strong credit.

● FHA Loans: Backed by the Federal Housing Administration; ideal for first-time buyers with lower credit.

● VA Loans: For eligible veterans and service members; no down payment or mortgage insurance required.

● USDA Loans: For low- to moderate-income buyers in rural areas; often no down payment needed.

Loan Types by Rate:

● Fixed-Rate: Same interest rate for the life of the loan—predictable and stable.

● Adjustable-Rate (ARM): Lower initial rate that adjusts over time—best if you plan to sell or refinance soon.

Understanding Interest Rates

When you take out a mortgage, you're not just repaying the amount you borrowed (the principal), you're also paying interest, which is the cost of borrowing money. Your monthly mortgage payment includes both principal and interest, with a larger portion going toward interest in the early years of the loan. Over time, as you repay more of the principal, the interest portion decreases, and you build more equity in your home. Interest rates can be fixed (stay the same for the life of the loan) or adjustable (change over time). The rate you receive depends on factors like your credit history, loan type, term length, down payment, and overall loan amount. Longer loan terms generally result in lower monthly payments but higher total interest paid over time. Understanding how interest works helps you compare lenders and choose the mortgage that fits your financial goals.

Understanding PMI & MIP

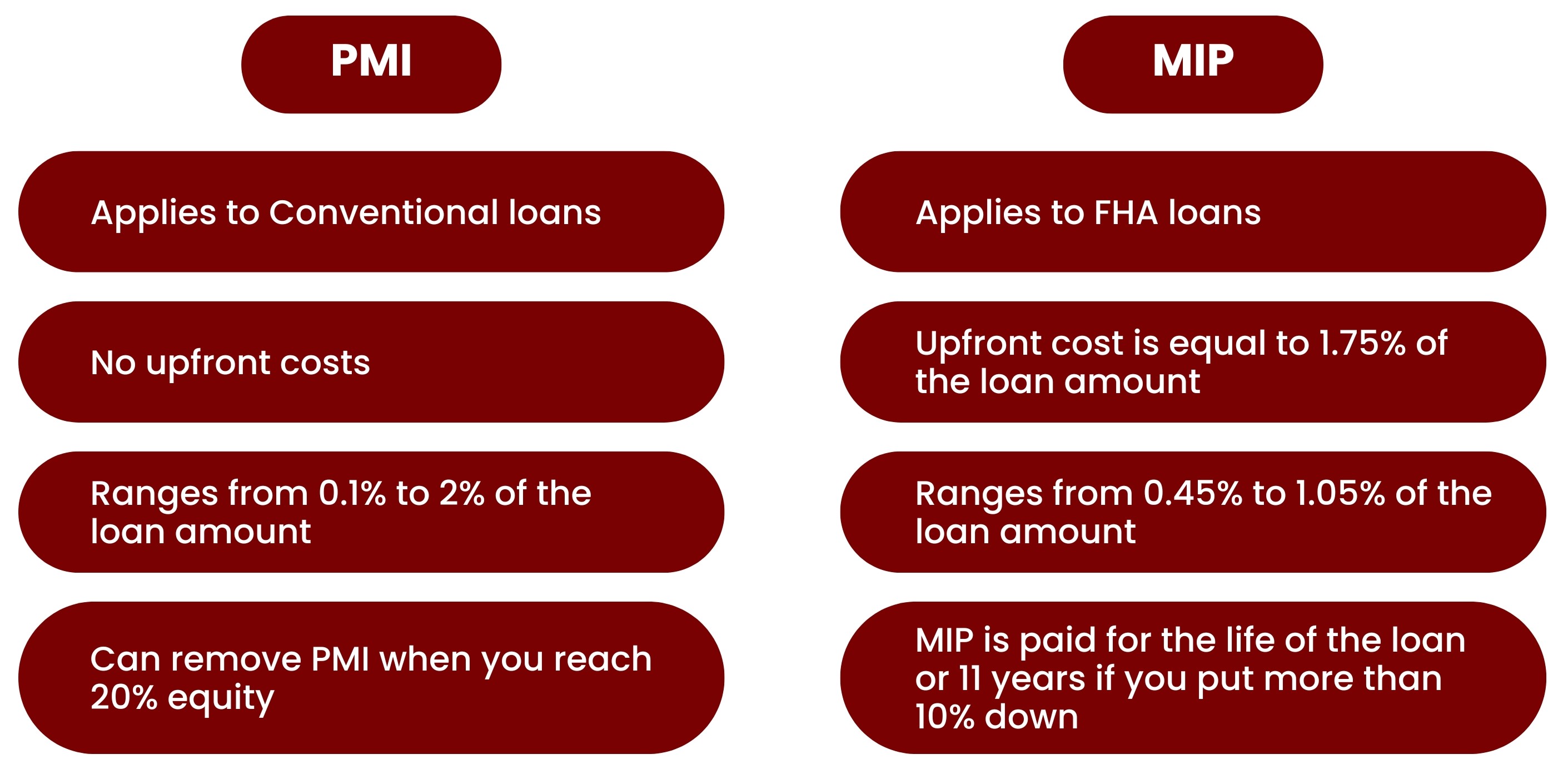

What is Private Mortgage Insurance (PMI)?

payment of less than 20%. It protects the lender if the borrower defaults on the loan. PMI is paid by the borrower as part of their monthly mortgage payment, and the cost depends on the loan amount and down payment size. Once the mortgage balance reaches 78% of the home’s original value, PMI is automatically canceled. However, borrowers can request PMI removal once their equity hits 20%. If the home’s value increases or the borrower pays down the mortgage to 80%, they can also request PMI removal, but an appraisal may be required.

What is Mortgage Insurance Premium (MIP)?

Mortgage Insurance Premium (MIP) is similar to PMI but applies to FHA loans. MIP is required for all FHA loans, regardless of the down payment size. FHA loans require both an upfront MIP and annual MIP payments. MIP is usually required for the life of the loan unless the borrower made a down payment of at least 10%, in which case it can be canceled after 11 years. To remove MIP sooner, borrowers must refinance their FHA loan into a conventional loan once they have enough equity.

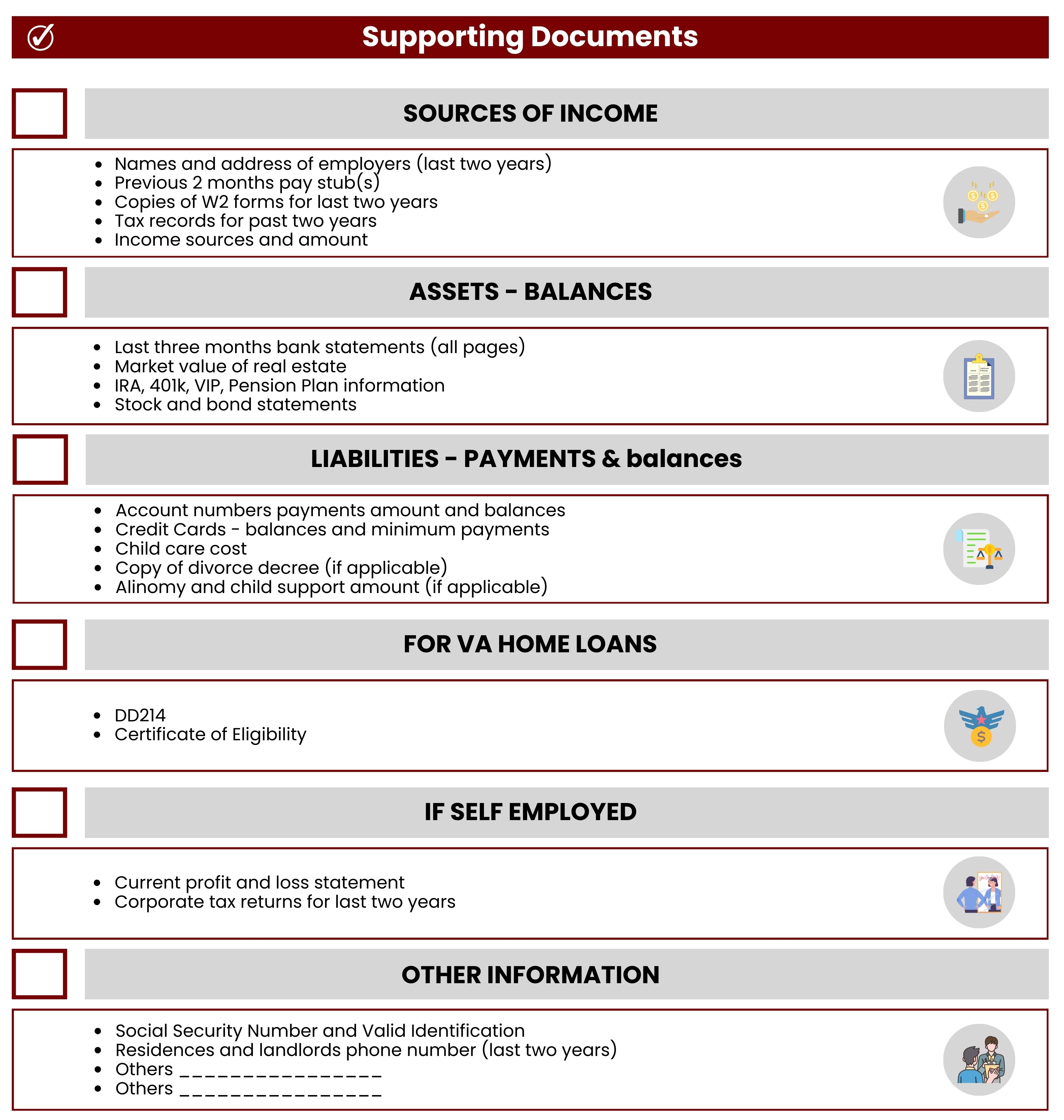

Mortgage Application Checklist

Get Pre-Approved for a Mortgage

Choose a Real Estate Agent

When you want to buy a home, you need a real estate agent, also called a buyer’s agent, to help you. They will work for you to get the best price and help you through the whole buying process. A good tip is to find an agent who knows the area where you want to live. Someone who knows the neighborhood well will be very helpful.

It’s also important to find an agent who can help you get better deals, like asking the seller to fix things or give you money to help with the cost. An experienced agent who works well with other agents will increase your chances of getting the home you want.

You can find an agent by asking people you know, checking online, or going to open houses. Once you have a list of agents, look at their websites to see how much experience they have, what kinds of homes they know about, and what other people think of them. After that, you can talk to them to see if you like working with them.

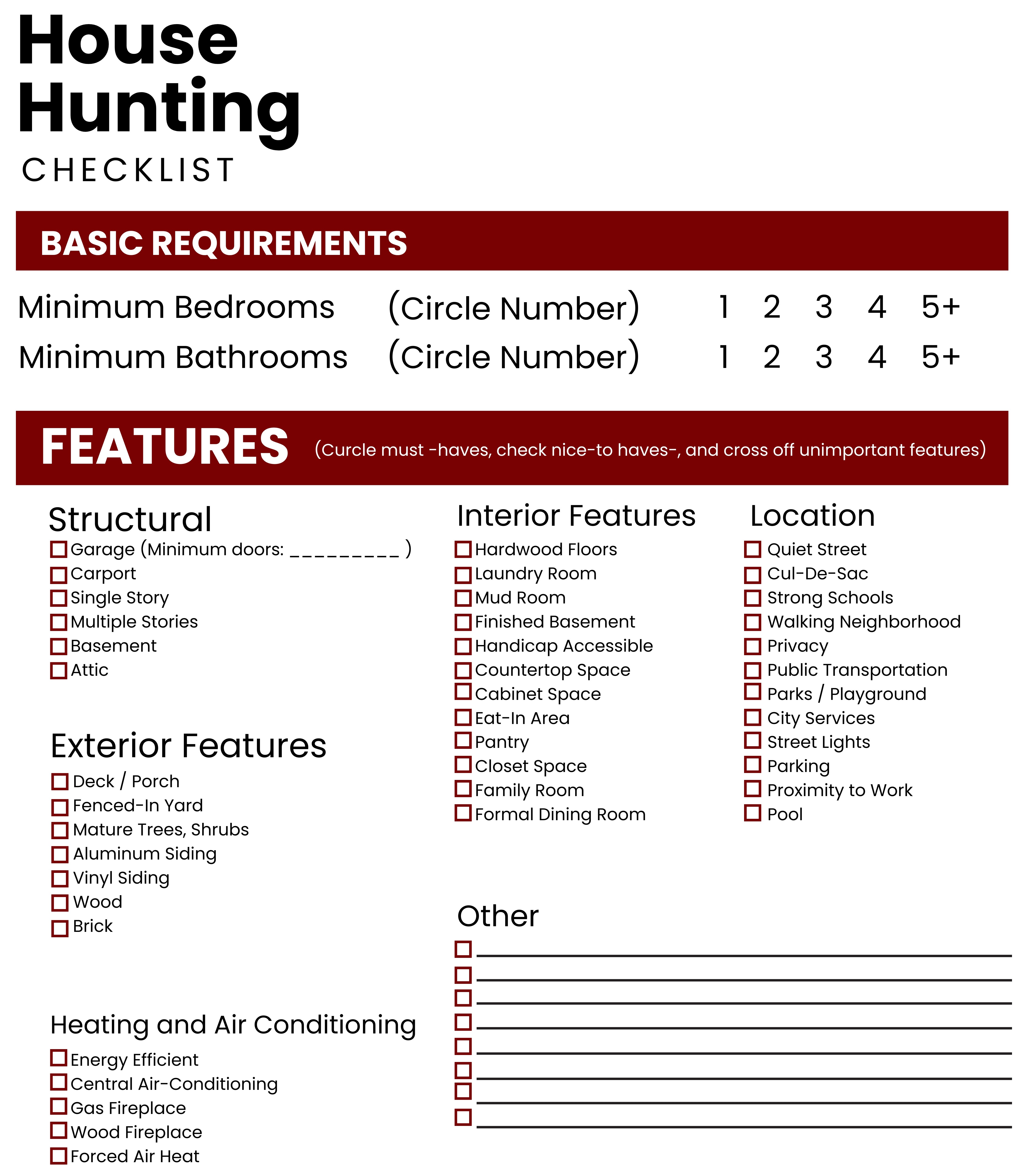

Defining Your Home Needs: Checklist

Before diving into house hunting, it's important to define your needs and wants for your new home. These can range from essential features like the number of bedrooms and proximity to schools, to preferences such as a large backyard or specific architectural style. To help with this, use a house hunting checklist to organize and prioritize what matters most. This will serve as a guide to make sure you stay focused and avoid overlooking key factors during your search. Below is a helpful checklist to get started.

Find the Right Home and Neighborhood

When touring homes online or in person, consider key factors like location, size, amenities, safety, property taxes, and price. If schools matter to you, research the local district's reputation. Attend open houses or schedule private tours with your real estate agent. Explore homes through listing sites, 3D tours, and detailed property descriptions. Visit neighborhoods at different times of day and talk to residents or browse local social media groups to get an authentic feel for the community.

Make an Offer

Once you find a home within your budget, the next step is to make an offer. This is a formal document that includes your proposed price, contingencies, earnest money, and preferred closing details, along with your mortgage pre approval letter. The seller can accept, reject, or counter your offer, and you can respond in kind. Once both sides agree, a purchase contract is signed, outlining the terms and timeline to close. If you're using a mortgage, your lender will order an appraisal to confirm the home's value. If the appraisal comes in low, you may need to renegotiate, cover the difference, or walk away depending on whether you included an appraisal contingency.

Home Inspection: What It Is and Why It Matters

If your offer includes a home inspection contingency, you’ll have a set period to schedule one. A licensed inspector checks the home’s structure and systems and provides a detailed report. If major issues are found, you can negotiate repairs or even cancel the deal if your contract allows it. While not always required, inspections are strongly recommended for peace of mind and protection.

Understand Closing Costs

As a buyer, you’ll be responsible for some closing costs in addition to your down payment. These costs will be outlined in your loan estimate early in the process and again in your closing disclosure, which you’ll receive three business days before closing. Typical buyer closing costs may include loan origination fees, mortgage points, appraisal fees, PMI premiums, homeowners insurance and tax escrows, deed recording, title insurance, notary and land survey fees, and prorated property expenses like taxes or utilities.

Best Practices for Closing on Time

1. Get Pre-Qualified Early

Connect with your loan officer to secure pre-qualification before making an offer. Begin gathering necessary financial documents and start comparing homeowners insurance providers.

2. Stay Organized After Contract Signing

Once your offer is accepted, sign all required disclosures within 24 hours. Submit any additional documents requested by your loan officer within 48 hours to avoid delays.

3. Plan Ahead and Communicate Clearly

Avoid last-minute changes or negotiations. Schedule repairs and final walk-throughs early in the process, list your closing attorney in the contract, and carefully coordinate if you’re involved in back-to-back closings.

What to Avoid During the Mortgage Process

To ensure a smooth mortgage process, avoid these common mistakes:

● Making large purchases: Avoid buying big-ticket items like furniture or cars, as they can affect your credit score and loan eligibility.

● Opening or closing credit lines: Any changes to your credit cards or loans can impact your credit score, potentially affecting your mortgage approval.

● Switching or quitting your job: Changes in employment can delay the process and may raise concerns for lenders.

● Taking out a personal loan: New loans can impact your debt-to-income ratio and credit score, making it harder to close on your home.

● Missing bill payments: Late or missed payments can hurt your credit score and delay closing.

● Disrupting the timeline: Stick to deadlines and submit paperwork promptly to prevent losing your loan terms.

What Happens on Closing Day?

Closing day is the final step in buying a home, when you sign all the required documents and officially take on the mortgage loan. This is also when you become the legal owner of the property. Depending on your state, the process may happen all at once or over several days and can include real estate agents, attorneys, title companies, and escrow officers. Some closings are done in person, others by mail or online. Make sure to carefully review each document before signing, as these carry long-term financial responsibilities.

Be Prepared for Homeownership Responsibilities

Once the closing is complete, documents are signed, and keys are in hand, you’re officially a homeowner. While this marks the end of the buying process, it’s the beginning of an important new chapter maintaining and protecting your investment.

As a homeowner, you're now responsible for timely mortgage payments, homeowners insurance, and property taxes. It’s also essential to prepare for the unexpected by budgeting for maintenance, repairs, and emergency expenses. A dedicated savings account for these costs can help you manage your home with confidence and avoid financial strain when issues arise.

The Bottom Line: Tips for First-Time Homebuyers

Purchasing your first home is a major financial decision, and having the right team on your side makes all the difference. Work closely with a trusted real estate agent, mortgage lender, and, if needed, a real estate attorney to navigate the process with confidence. Don’t hesitate to ask questions, seek clarification, or lean on their expertise this is one of the biggest purchases of your life, and informed decisions are key to long-term success.