Temporary Rate Buydowns: A Strategic Tool or Mortgage Gimmick?

| May 16 2025

| Published by MSJ Mortgage

In today’s evolving real estate market, homebuyers are exploring various financing strategies aimed at making homeownership more accessible. Among these strategies, temporary rate buydowns have become increasingly popular. But the question remains: are they a clever financial tool or just another mortgage gimmick? At Mission San Jose Mortgage, our mission as brokers is not just to sell you a loan but to guide you toward smart, informed financial decisions. Let’s break down the mechanics and benefits of temporary rate buydowns in a way that’s easy to understand and relevant to your home buying journey.

Understanding Temporary Rate Buydowns

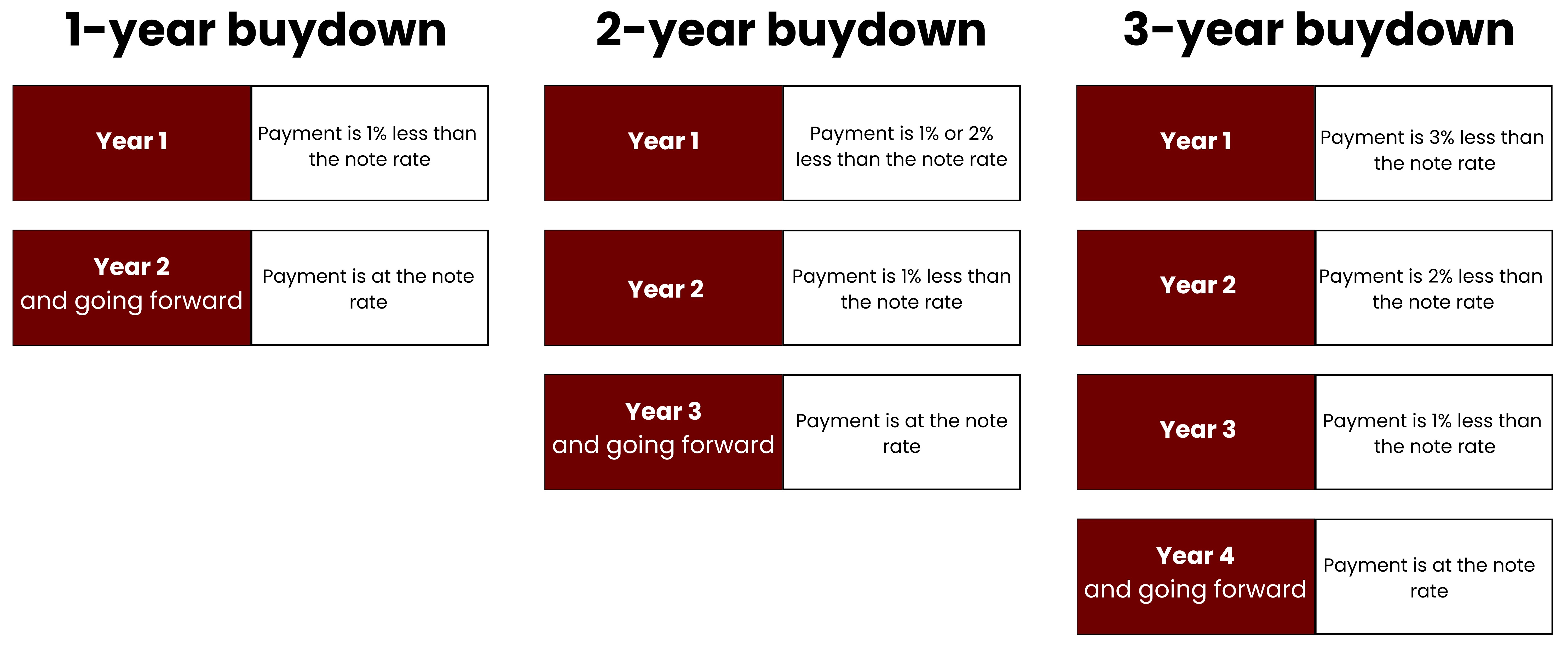

Temporary rate buydowns are special financing plans that lower your initial mortgage payment by reducing the interest rate for a set period of time. How long these interest rate reductions last will depend on the option you choose.

While a temporary rate buydown lowers your initial payments, it‘s important to understand that it does not reduce your actual note rate, The rate used to calculate your loan’s long-term cost. Instead, it’s more like a temporary payment relief program. Funds, typically provided by the seller, are placed into an escrow account at closing. These funds are then used to lower your monthly mortgage payments for a set period, usually one to three years. During this time, your payments are calculated at a reduced interest rate, even though your original loan rate remains unchanged.

How It Works: The Process Explained

Let‘s look at how a temporary buydown works step by step. When you close on your new home, money is set aside in a special account (called an escrow account). This money is specifically for lowering your mortgage payments for a while. It could reduce your interest rate by as much as 3% in the first few years with a 3-2-1 buydown. This fund helps cover the difference in your payments during the initial years of your loan.

Each month, the company managing your mortgage will use some of the money from this escrow account to bring down your payment. Even though you‘re paying less each month temporarily, the amount you owe on your house (the loan balance) is still decreasing at the same pace as if you were making the full payment. Over time, the interest rate will gradually increase, usually by 1% each year, until it reaches the original rate you agreed to. This continues until the special savings in the escrow account run out, as they are used to make up the difference between your reduced payment and the full amount.

Who Pays for the Buydown?

There are generally three ways a temporary buydown can be paid for, but some ways are much better for the buyer than others.

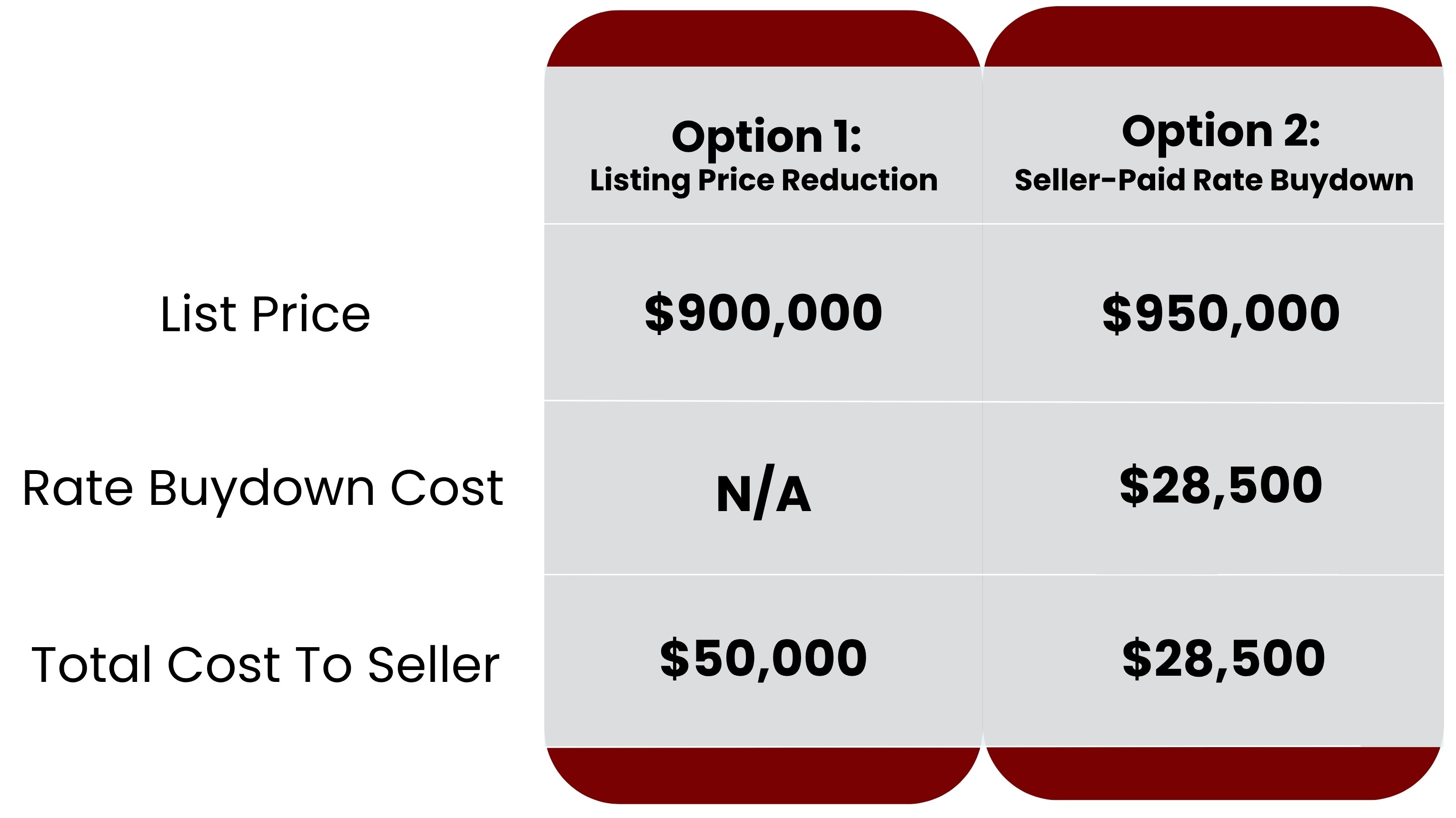

When the Seller Pays: The best situation for the buyer is often when the person selling the house covers the cost. If the housing market is competitive or if things are slowing down, sellers might offer to pay for a buydown instead of lowering the price of the house. For instance, instead of reducing the price by $50,000, the seller might give the buyer $28,500 to put towards a 3-2-1 buydown. This means the buyer will save a good amount on their monthly payments at the beginning, and the seller might still get closer to their original asking price.

When the Buyer Pays: Paying for the buydown yourself is usually not the best idea. Using the buyer‘s own money upfront to have lower payments for a short time might not be smart, especially since those funds could be used for savings or other costs that come with buying a house.

When the Lender Pays: Sometimes, lenders might offer a buydown that looks like a bonus. However, the cost of this lower payment is usually hidden in a higher interest rate that the buyer will pay for the entire loan or in other fees. So, while the buyer‘s initial payments are lower, they could end up paying more money overall in the long run. Plus, if the buyer decides to refinance their loan early, they won‘t get back any of the extra cost they paid for that temporary lower payment.

Why Would a Seller Offer a Buydown Instead of Lowering the Price?

Imagine a seller has a house listed for $950,000, but they aren‘t getting any offers. To attract buyers, they might have to reduce the house price to $900,000, meaning they‘d lose $50,000. However, another option is for the seller to contribute $28,500 towards a temporary buydown for the buyer (like a 3-2-1 buydown).

By offering this buydown, the seller spends significantly less than the $50,000 price drop. Plus, the buyer benefits from lower monthly payments for the first few years, which can make the house more appealing and could lead to the seller finally getting those offers they need. So, the seller potentially saves money and gets offers, while the buyer enjoys initial affordability.

This example shows how both parties can benefit: the seller retains more value from the sale, while the buyer enjoys lower initial payments.

What Are the Actual Savings for Buyers?

Let’s explore what this looks like from the buyer’s perspective. Suppose you‘re purchasing a $900,000 home with a 30-year mortgage at 7.250%. A 3-2-1 seller-paid buydown would reduce your interest rate for the first three years as follows:

These upfront savings can provide buyers with valuable financial flexibility, especially when transitioning into homeownership or planning for future income increases.

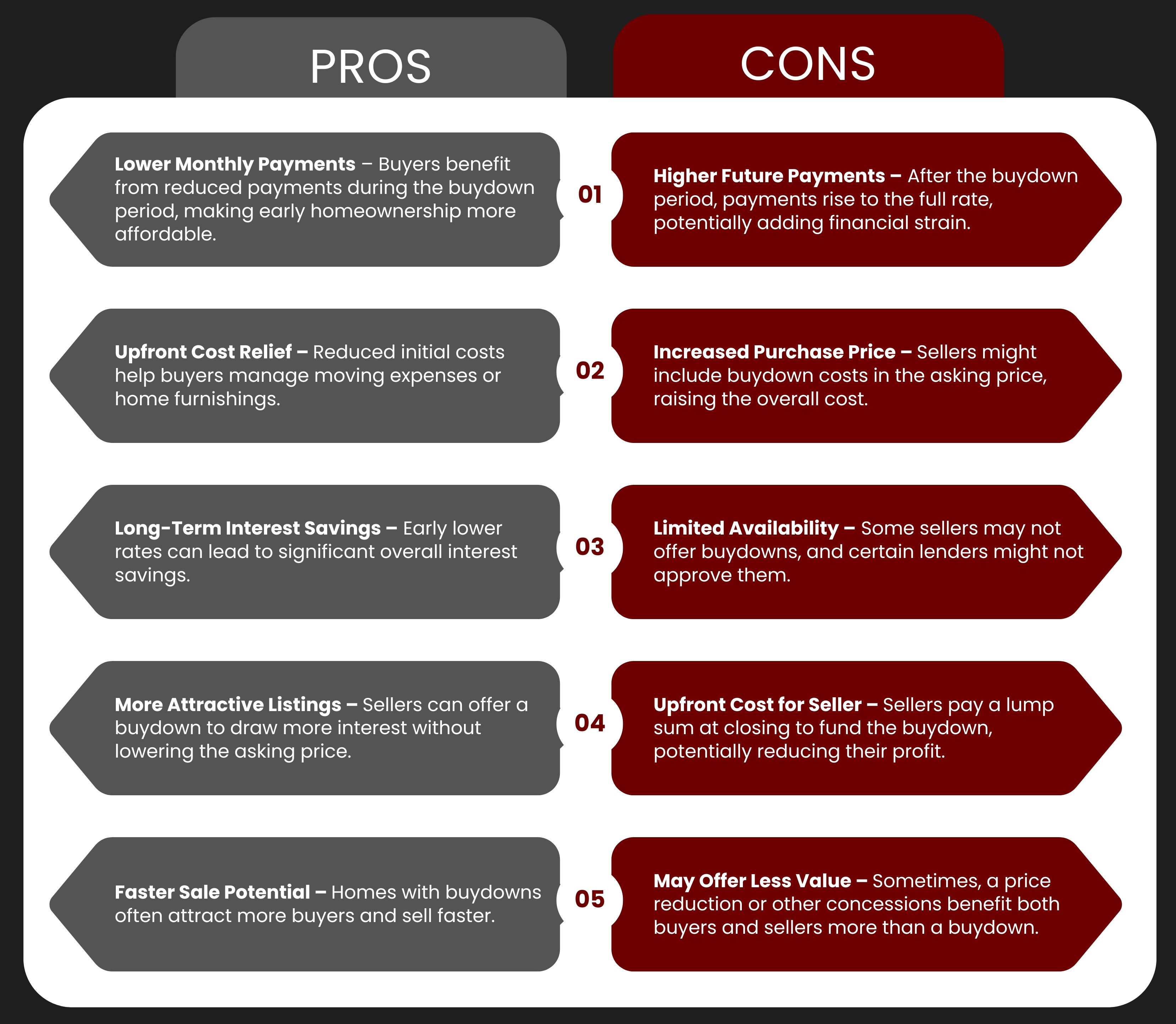

Seller-Paid Buydown: Pros and Cons

Will a Temporary Buydown Help Me Qualify for More?

It’s important to understand that mortgage lenders qualify borrowers based on the full note rate, Not the temporary lower rate. So even if your monthly payments are reduced for the first few years, your qualification is based on the original interest rate. This ensures you can afford the full payments once the buydown ends.

What If I Refinance Early?

This is where seller-paid buydowns shine. If you refinance before the buydown period ends, any remaining escrow funds are either refunded to you or applied to your loan balance. It’s similar to how unused escrow for property taxes or insurance is handled at loan payoff. However, with lender-paid buydowns, those unused funds are not recoverable, So exiting the loan early could mean leaving money on the table.

Final Thoughts

Temporary buydowns are not a gimmick when used wisely. If the seller is covering the cost and your goal is to ease into your mortgage, a temporary buydown can offer meaningful short-term savings without long-term financial risk. On the other hand, if you’re paying for it yourself or the lender is building the cost into the rate, it may not be worth it, Especially if you plan to refinance or sell in the near future.

At Mission San Jose Mortgage, we work with a variety of lenders and loan programs to ensure you have options that make sense. If a temporary buydown aligns with your needs, we’ll help structure it properly. And if there’s a better use for your seller credit like covering closing costs, we’ll walk you through those alternatives too.

Ready to make a confident move toward homeownership? Contact the experts at Mission San Jose Mortgage today. We’re here to help you win the deal and the home.