Tapping Into Home Equity: Is a Cash-Out Refinance Right for You?

| May 23 2025

| Published by MSJ Mortgage

When it comes to unlocking the financial potential of your home, a cash-out refinance is a popular option that many homeowners consider. At Mission San Jose Mortgage, we understand that your home is more than just a place to live, it‘s also an investment that can help you achieve your financial goals. Whether you’re looking to fund home improvements, pay off high-interest debt, or cover other major expenses, tapping into your home equity through a cash-out refinance can provide the funds you need. This guide will walk you through how a cash-out refinance works, what to consider, and how to make it work best for you.

What Is a Cash-Out Refinance?

A cash-out refinance is a type of mortgage where you replace your current home loan with a new, larger one and take the difference in cash. That cash comes from the equity you’ve built up in your home, either by paying down your mortgage or through an increase in your home’s value.

You can use the money for almost anything: home improvements, paying off high-interest debt, or other big expenses. The new loan may have a different interest rate or loan term than your original mortgage.

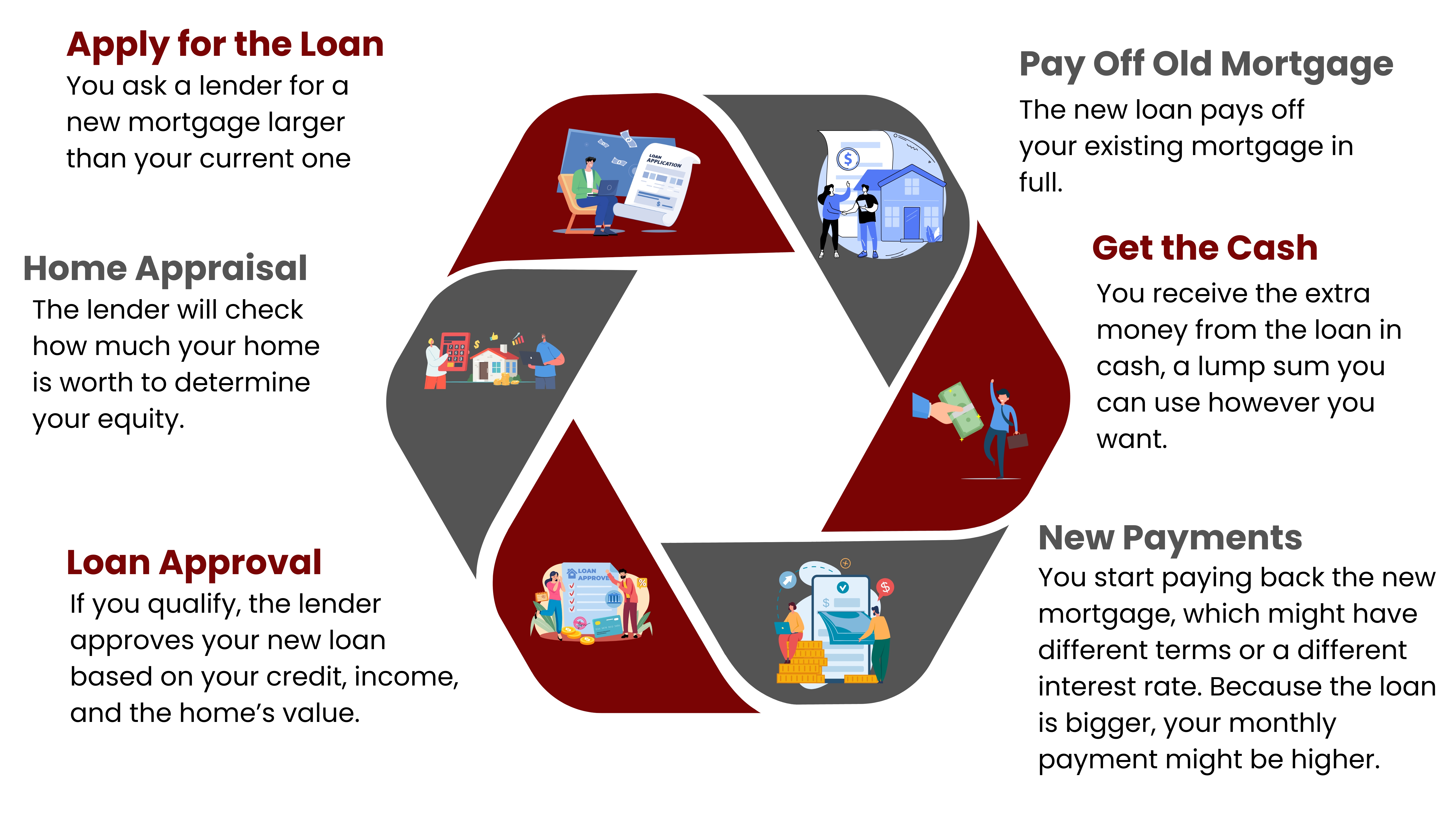

How Does a Cash-Out Refinance Work?

A cash-out refinance lets you replace your current mortgage with a new, larger loan. The extra amount you borrow comes from the equity you’ve built in your home. That‘s the difference between what your home is worth and what you still owe.

Here’s what usually happens during the process:

While a cash-out refinance gives you access to cash, keep in mind that borrowing more means you’ll owe more and probably pay more each month. It’s important to weigh these factors before deciding if this is the right option for you.

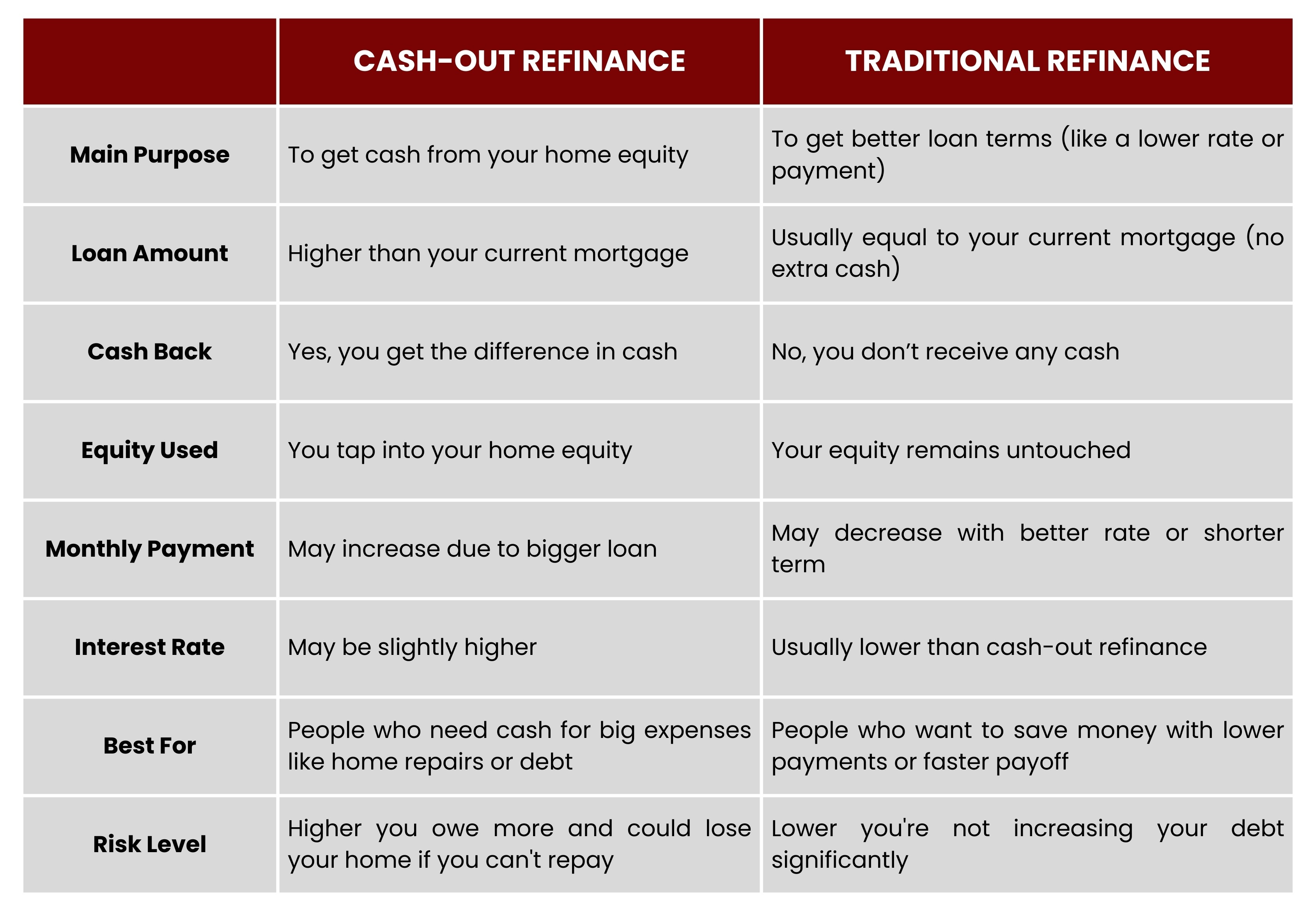

Cash-Out Refinance vs. Traditional Refinance

In short, a cash-out refinance helps you access money, while a traditional refinance helps you save money. The right choice depends on your financial goals whether you need cash now or want to lower your monthly costs.

Reasons Homeowners Choose a Cash-Out Refinance

Homeowners choose a cash-out refinance for many reasons, the main one being to turn their home equity into usable cash. That money can be used for:

● Paying off high-interest debt, like credit cards or personal loans.

● Making home improvements, such as remodeling, repairs, or upgrades.

● Covering education costs, like college tuition or training programs.

● Investing in a business, or purchasing rental property.

● Changing loan terms, such as switching from an adjustable to a fixed rate or securing a lower interest rate.

While a cash-out refinance can be a smart way to access funds, keep in mind that it increases your loan amount and may raise your monthly payment. It’s important to carefully consider whether the benefits outweigh the added cost before moving forward.

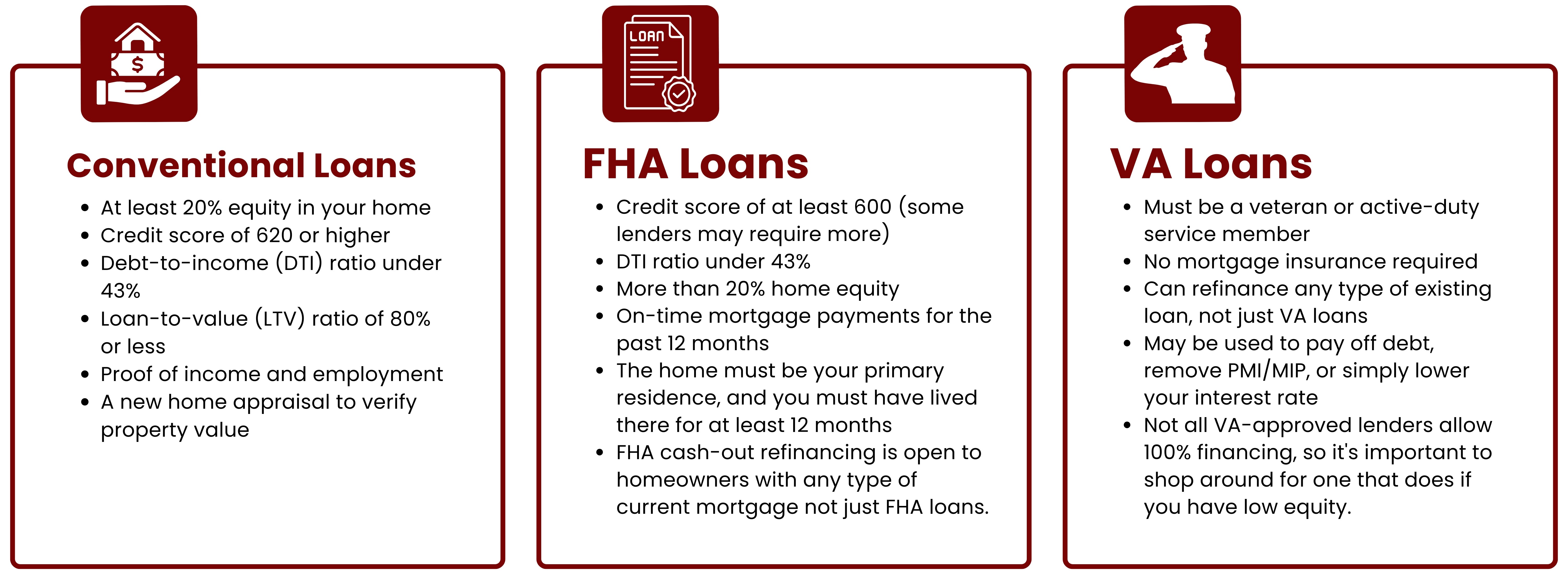

Eligibility Requirements for a Cash-Out Refinance

To get a cash-out refinance, you‘ll need to meet certain requirements just like you did when you first got your mortgage. These requirements can vary by lender and loan type (conventional, FHA, or VA), but here’s what most homeowners should expect:

Each type of cash-out refinance has its own rules, but in general, you’ll need solid credit, enough home equity, and proof that you can repay the new loan. If you’re a veteran or qualify for an FHA loan, you may have even more flexible options.

How Much Cash Can You Get from a Cash-Out Refinance?

The amount of cash you can pull from a cash-out refinance depends mainly on three things: your home’s current value, how much you still owe on your mortgage, and your lender’s loan-to-value (LTV) limits.

In most cases, lenders allow you to borrow up to 80% of your home’s appraised value, subtracting your current mortgage balance. For example, if your home is worth $400,000 and your remaining mortgage is $100,000, you may be eligible to refinance up to $320,000 (at 80% LTV). After paying off the mortgage, you could pocket the difference of $220,000 as cash.

What Affects How Much You Can Get?

Several factors influence how much cash you can access:

● Equity in your home: More equity means more potential cash.

● Loan-to-value (LTV) or combined LTV (CLTV): This determines how much total debt your lender will allow based on your home’s value.

● Your credit score and debt-to-income (DTI) ratio: Better credit and lower DTI typically qualify you for larger loan amounts and better terms.

Just keep in mind the more equity you cash out, the larger your new mortgage and monthly payment will be. So make sure the cash-out benefits outweigh the added costs.

The Process of Getting a Cash-Out Refinance

Getting a cash-out refinance is similar to applying for a new mortgage, but with the added benefit of receiving cash from your home’s equity. Here’s how it works:

1. Check Your Equity Estimate your home’s current value and subtract what you owe to see how much equity you can tap into.

2. Review Your Finances Lenders look at your credit score, income, and debt-to-income ratio to determine your eligibility.

3. Compare Lenders Shop around to find the best rates, fees, and terms.

4. Apply and Provide Documents Submit your application along with proof of income, assets, and debts.

5. Home Appraisal Your lender will assess your home’s value to finalize how much you can borrow.

6. Loan Approval & Closing If approved, you’ll close on the new mortgage, your old loan will be paid off, and you’ll receive your cash.

7. Start New Payments Begin making payments on your new loan balance with updated terms.

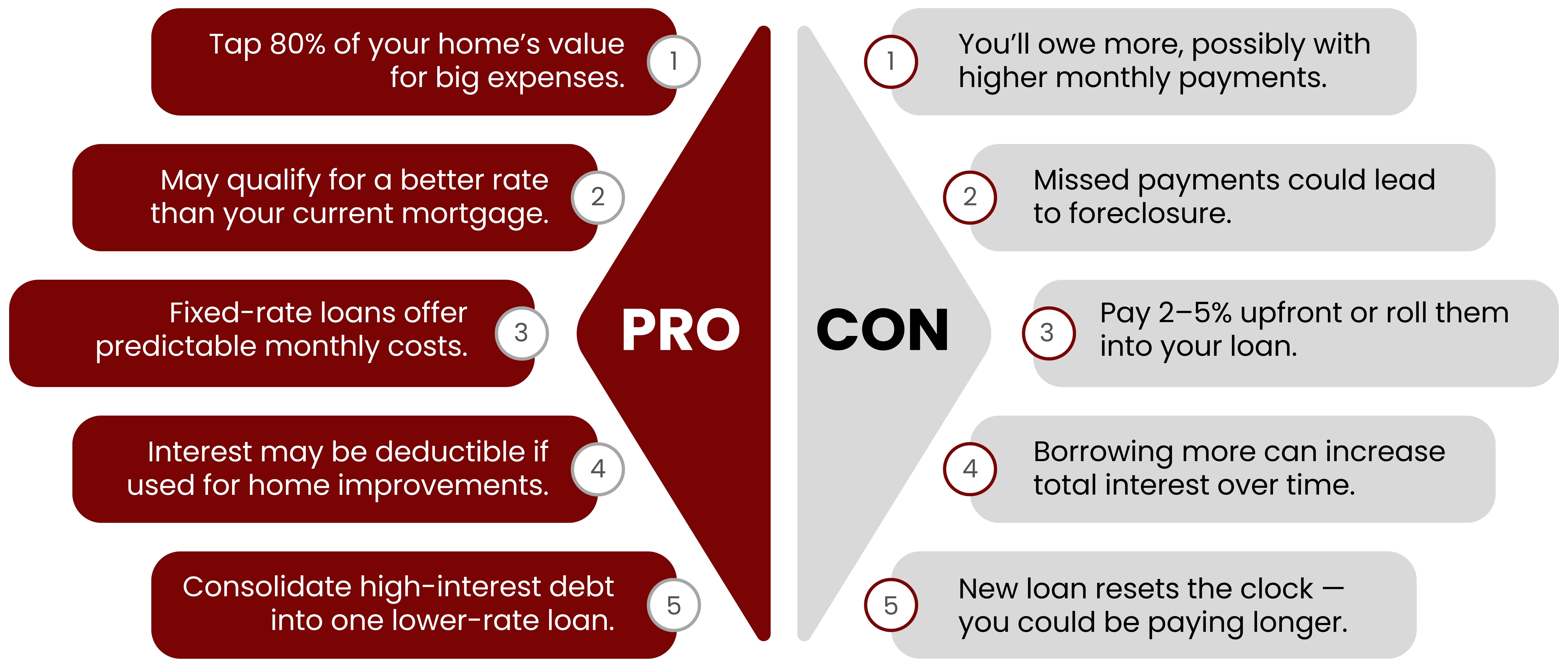

Cash-Out Refinance: Pros & Cons

When Is a Cash-Out Refinance a Good Idea?

Whether a cash-out refinance is right for you depends on your unique financial goals and current mortgage situation. Here are some scenarios where it could make financial sense:

1. You’re Looking for a Lower Interest Rate

If mortgage rates have dropped or your credit score has improved since your original loan, refinancing could get you a better rate. A lower rate means reduced monthly payments and significant interest savings over time.

2. You Want to Change Loan Types

Switching from an adjustable-rate mortgage (ARM) to a fixed-rate loan can offer stability, especially if you’re concerned about rising interest rates. Conversely, if you plan to sell your home soon, refinancing from a fixed-rate to an ARM might lower your payments in the short term.

3. You Want to Pay Off Your Loan Faster

Cash-out refinancing also gives you the chance to choose a shorter loan term. While monthly payments may increase, a 15-year mortgage can help you pay off your home faster and save thousands in long-term interest.

When Should You Avoid a Cash-Out Refinance?

While a cash-out refinance can be a powerful financial tool, it’s not always the best solution. Here are a few situations where it might be better to explore other options:

1. You Don’t Really Need the Cash

If you’re being offered a cash-out refinance but don’t have a clear need for the money, think twice. For non-essential expenses or “nice-to-haves,” consider a home equity line of credit (HELOC) instead. With a HELOC, the funds are available when needed, and you only pay interest on what you actually use.

2. You’re Unsure How Much You Need

Planning a series of home improvements but don’t know the total cost yet? A cash-out refinance gives you a lump sum, which means you’ll pay interest on the full amount even if you don’t use it all. If your project costs more than expected, you might need to borrow again, adding more fees. In this case, a HELOC may offer more flexibility.

3. The Numbers Don’t Make Sense

Always run the numbers before refinancing. If a cash-out refinance ends up costing more over time than simply keeping your current mortgage and adding a HELOC or home equity loan, it’s likely not the smartest move financially.

Cash-Out Refinance Costs to Consider

When considering a cash-out refinance, it’s important to be aware that the process isn’t free; it comes with its own set of closing costs, similar to when you first took out your mortgage. These costs typically range from 2% to 6% of your total loan amount. For example, refinancing a $200,000 mortgage could cost you between $4,000 and $10,000. The exact amount can vary based on several factors, including your loan size, credit score, lender, property location, home equity, and whether you’re opting for a fixed or adjustable-rate mortgage. Common expenses include loan origination fees, appraisal costs, title insurance, credit checks, attorney fees, and more. Some of these charges, especially lender fees may be negotiable, while others, like appraisal or recording fees, are usually set by third parties. It’s also worth noting that rolling closing costs into your new loan will increase your total balance and long-term interest, so weighing short-term cash needs against long-term financial impact is crucial. Working with a transparent broker like Mission San Jose Mortgage can help you better understand which costs are negotiable and how to minimize them effectively.

Alternatives to a Cash-Out Refinance

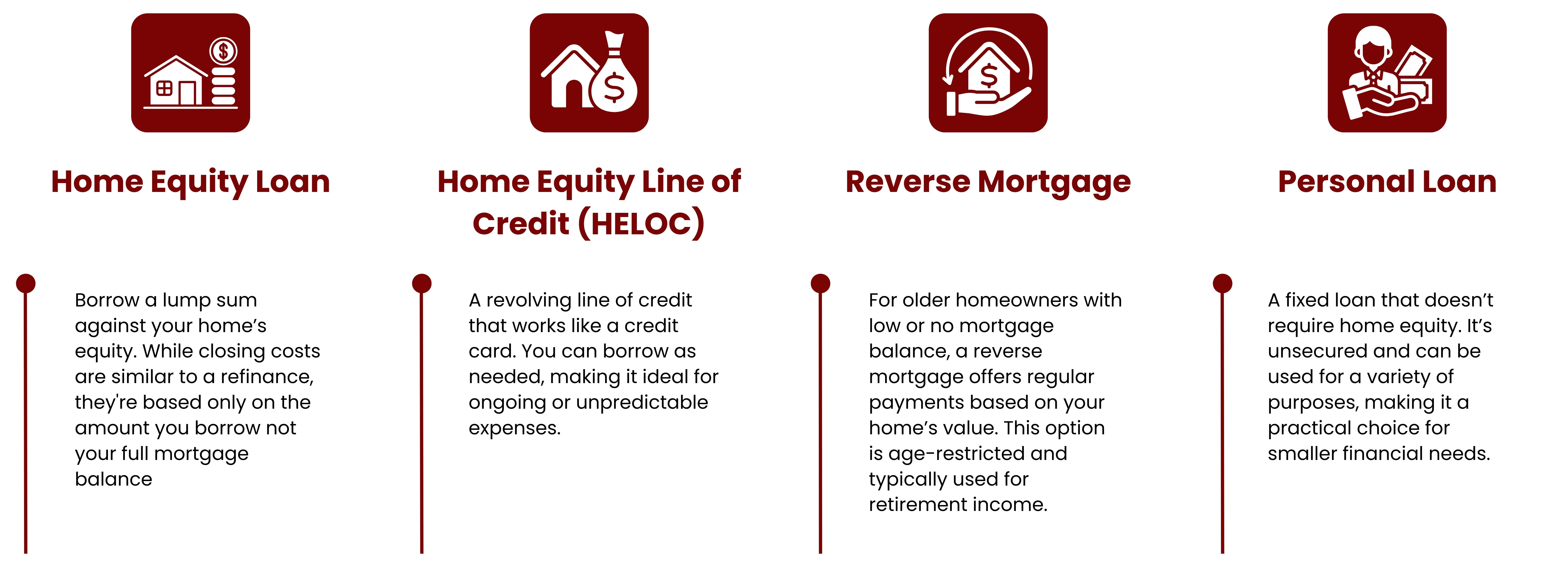

If a cash-out refinance doesn’t suit your needs or you don’t qualify for one, there are other ways to access funds. Depending on your financial goals and how much you need to borrow, one of these alternatives might be a better fit:

Cash-Out Refinance and Taxes: What to Know

A cash-out refinance allows you to borrow against your home equity without triggering a taxable event, since the funds you receive are considered a loan not income or capital gains. In fact, you may even be eligible for tax deductions if the cash is used to “buy, build, or substantially improve” your home, according to IRS guidelines. For example, if you use part of the cash for home renovations and the rest for a vacation, only the portion tied to substantial improvements may qualify for a mortgage interest deduction. However, there are limits: you can deduct interest only on up to $750,000 of total mortgage debt (or $375,000 if married filing separately), unless your loan originated before December 16, 2017. While cash-out refinance can come with upfront costs, their tax advantages can help offset some of those expenses. To ensure you‘re maximizing your deductions and complying with IRS rules, it’s wise to consult a qualified tax professional.

Tips to Maximize the Benefits of a Cash-Out Refinance

A cash-out refinance can be a powerful financial tool to access your home equity and achieve important financial goals. However, to truly benefit from it, you need a clear plan and smart strategies. Below are key tips to help you maximize the advantages of a cash-out refinance whether you’re looking to reduce debt, improve your home’s value, or make other investments.

Tip 1: Define Your Financial Goals

Before starting, get clear on why you‘re refinancing. Whether it’s paying off high-interest debt, upgrading your home, or covering educational expenses your end goal should shape how you use the funds.

Tip 2: Boost Your Credit Profile

Lenders reward strong credit with better interest rates. Review your credit report, correct any errors, and avoid new debt. A higher score can mean big savings over the life of your loan.

Tip 3: Compare Lenders for the Best Deal

Don’t settle on the first offer. Shop around and compare interest rates, fees, and loan terms. A lower rate or reduced closing costs can make a major difference in your total refinance cost.

Tip 4: Invest in High-ROI Home Projects

Use the funds for upgrades that increase your home’s value. Kitchen remodels, bathroom updates, energy-efficient improvements, and curb appeal enhancements tend to offer great returns.

Tip 5: Understand Tax Implications

The interest on your new mortgage may be tax deductible but only if the cash is used for qualified home improvements. Consult a tax expert to make sure your plans meet IRS guidelines.

Tip 6: Watch Your Debt-to-Income Ratio

Lenders evaluate your DTI to gauge your ability to repay the loan. Keeping it low improves your chances of approval and could unlock better loan terms.

Tip 7: Use the Funds Responsibly

Avoid the temptation to spend on luxuries or non-essential items. Treat the cash-out as an investment and apply it where it will improve your financial health long-term.

Tip 8: Preserve Your Home Equity

Be cautious about cashing out too much. Holding onto a healthy cushion of equity protects you if property values drop and keeps future refinance options open.

Tip 9: Consult Financial Professionals

From mortgage brokers to tax advisors, experts can help you navigate complexities and tailor your refinance strategy to your unique situation.

Tip 10: Stay Tuned Into the Market

Interest rates and home values fluctuate. Monitoring market conditions helps you time your refinance for the greatest benefit.

Tip 11: Explore Alternative Options

Cash-out refinance isn’t your only choice. Depending on your needs, a home equity loan or HELOC might be more flexible or cost-effective.

Final Thoughts

A cash-out refinance can be a powerful way to access the equity you’ve built in your home and turn it into cash for important financial needs. At Mission San Jose Mortgage, we emphasize the importance of weighing the benefits against the costs, including higher monthly payments and closing expenses. By clearly defining your financial goals and exploring all your options, you can make a smart decision that strengthens your financial future. With the right planning and professional guidance, a cash-out refinance could be the tool you need to unlock new opportunities while protecting your long-term home investment.