Pre-Qualification vs. Pre-Approval: What’s the Difference?

| June 05 2025

| Published by MSJ Mortgage

If you're starting your home buying journey, you've probably come across the terms pre-qualification and pre-approval often used interchangeably, though they mean very different things. These two steps serve distinct purposes and can significantly influence how smoothly your mortgage process goes.

At Mission San Jose Mortgage, we often work with first-time buyers who feel overwhelmed by all the mortgage terminology. That’s completely understandable, home financing terms can feel like a different language. But understanding the difference between getting pre-qualified and getting pre-approved can give you a real advantage in today’s competitive housing market.

In this blog, we’ll break down what each of these steps really means, how they differ, and when you might need one over the other. Whether you’re just beginning to explore your options or you’re ready to make an offer, Mission San Jose Mortgage, your trusted mortgage broker, is here to help you feel confident, informed, and financially prepared every step of the way.

Understanding the Basics: What Is Pre-Qualification?

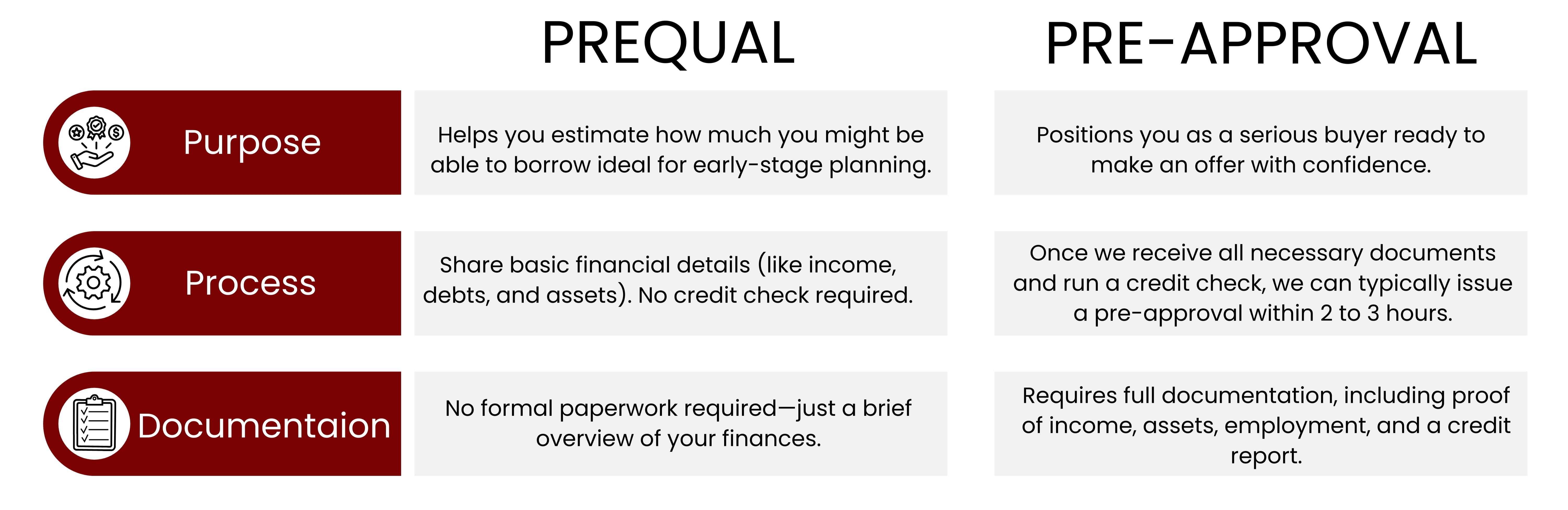

Pre-qualification is an early step in the mortgage process that gives you a general sense of how much you may be able to borrow. It’s typically informal and involves a quick conversation or online form where you share basic financial details such as your income, debts, and assets. Since this step doesn’t require submitting documents or pulling your credit report, it’s a low-pressure way to begin assessing your home buying budget.

As mortgage brokers, we use pre-qualification to help clients identify potential challenges like budget limits or credit concerns before they dive into the home search. While it doesn’t guarantee loan approval, it provides valuable insight into your financial readiness. For first-time buyers or those early in the planning stage, pre-qualification is a smart way to build clarity and confidence as you move forward.

What Does Pre-Approval Really Mean?

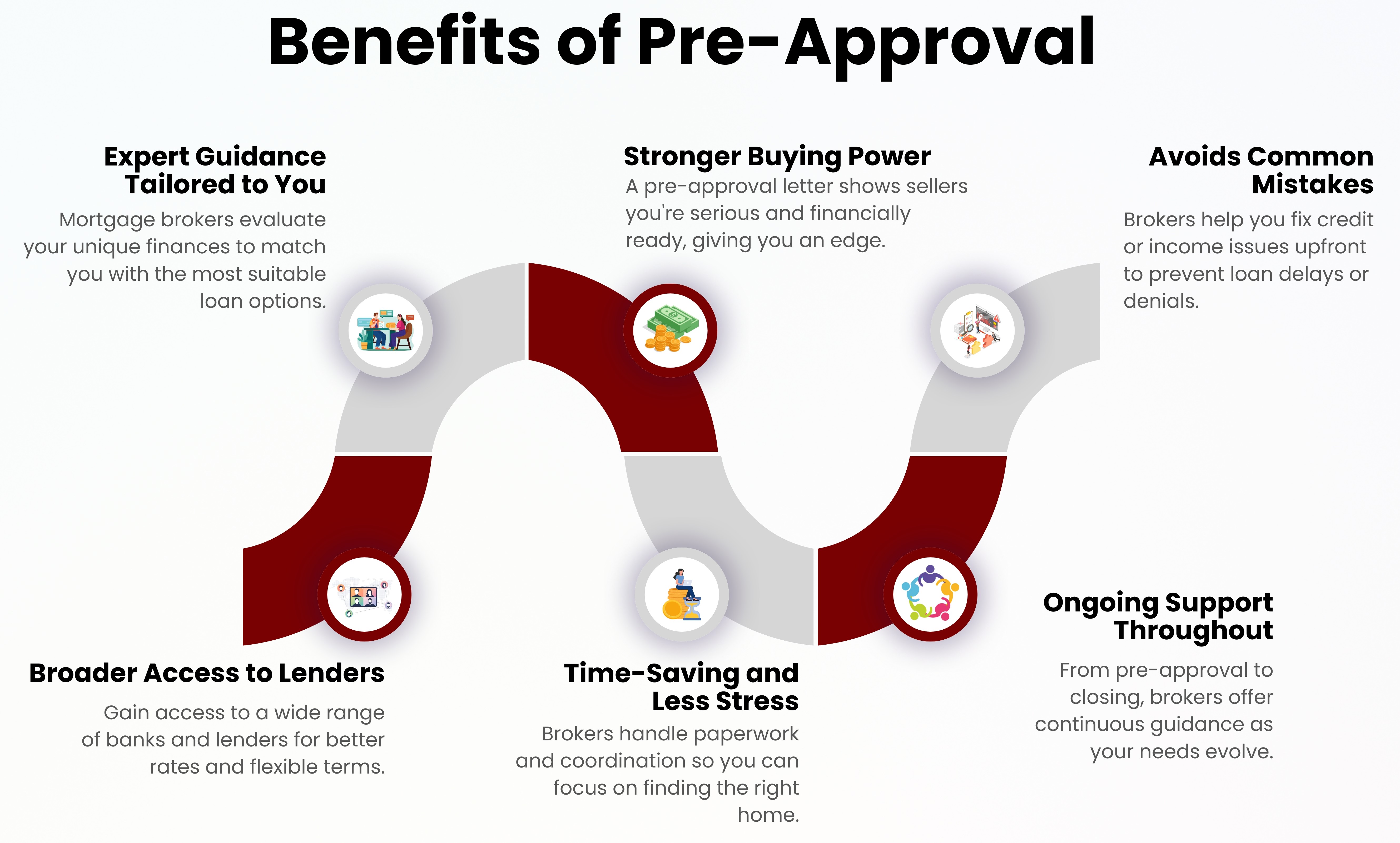

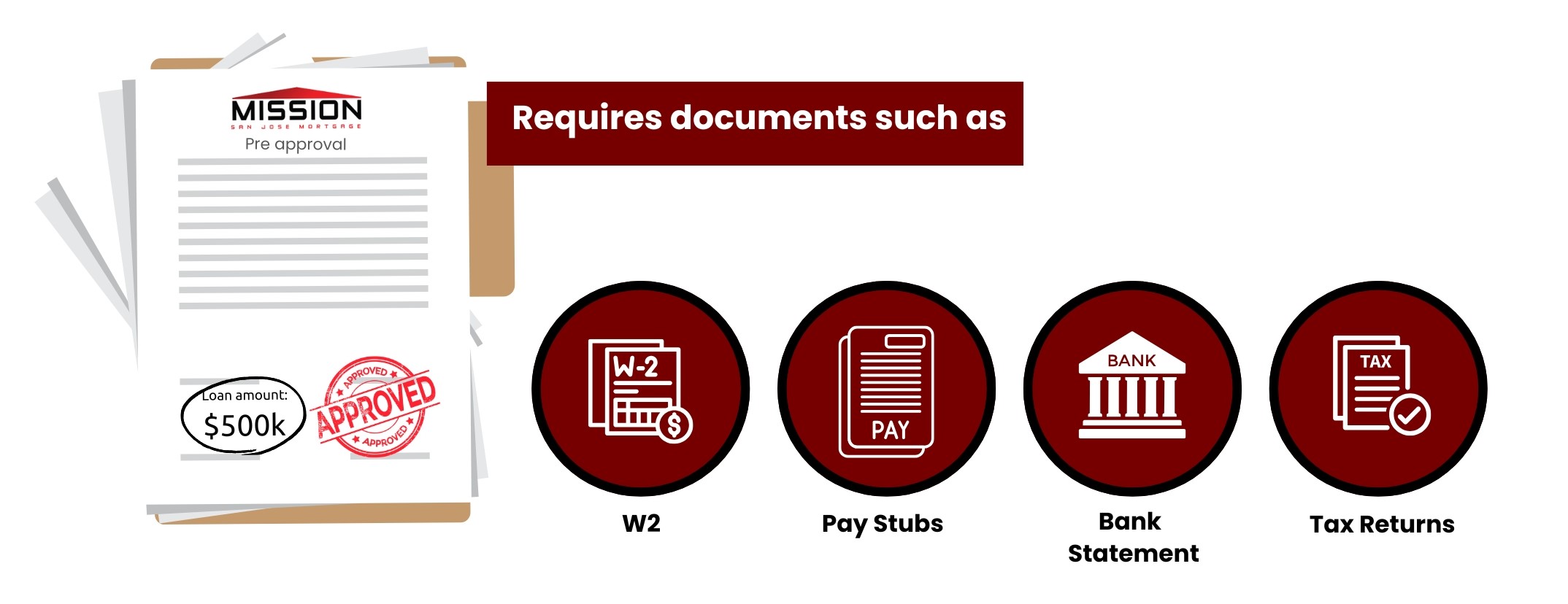

Mortgage pre-approval is a crucial and formal step in the homebuying process that provides a verified assessment of your creditworthiness. Unlike pre-qualification, which is based on self-reported information, pre-approval requires a full mortgage application. As brokers, we carefully review your financial documents including income, employment history, assets, and debts and run a credit check. If everything aligns, we issue a pre-approval letter that outlines how much you’re qualified to borrow. While not a final loan commitment, it’s a strong indicator of your borrowing power and is typically valid for around 30 days, with the possibility of being extended up to 90 days or longer if your financial situation remains unchanged.

Pre-approval gives you a clear sense of your home buying budget and strengthens your position when making offers. Sellers and agents often prioritize offers from pre-approved buyers, viewing them as serious and financially ready. However, it's important to remember that final loan approval comes after you’ve selected a property and completed the underwriting process. During that stage, you may be asked for additional documentation or clarifications, so staying organized and responsive is key.

Key Differences Between Pre-Qualification and Pre-Approval

Which One Do You Need and When?

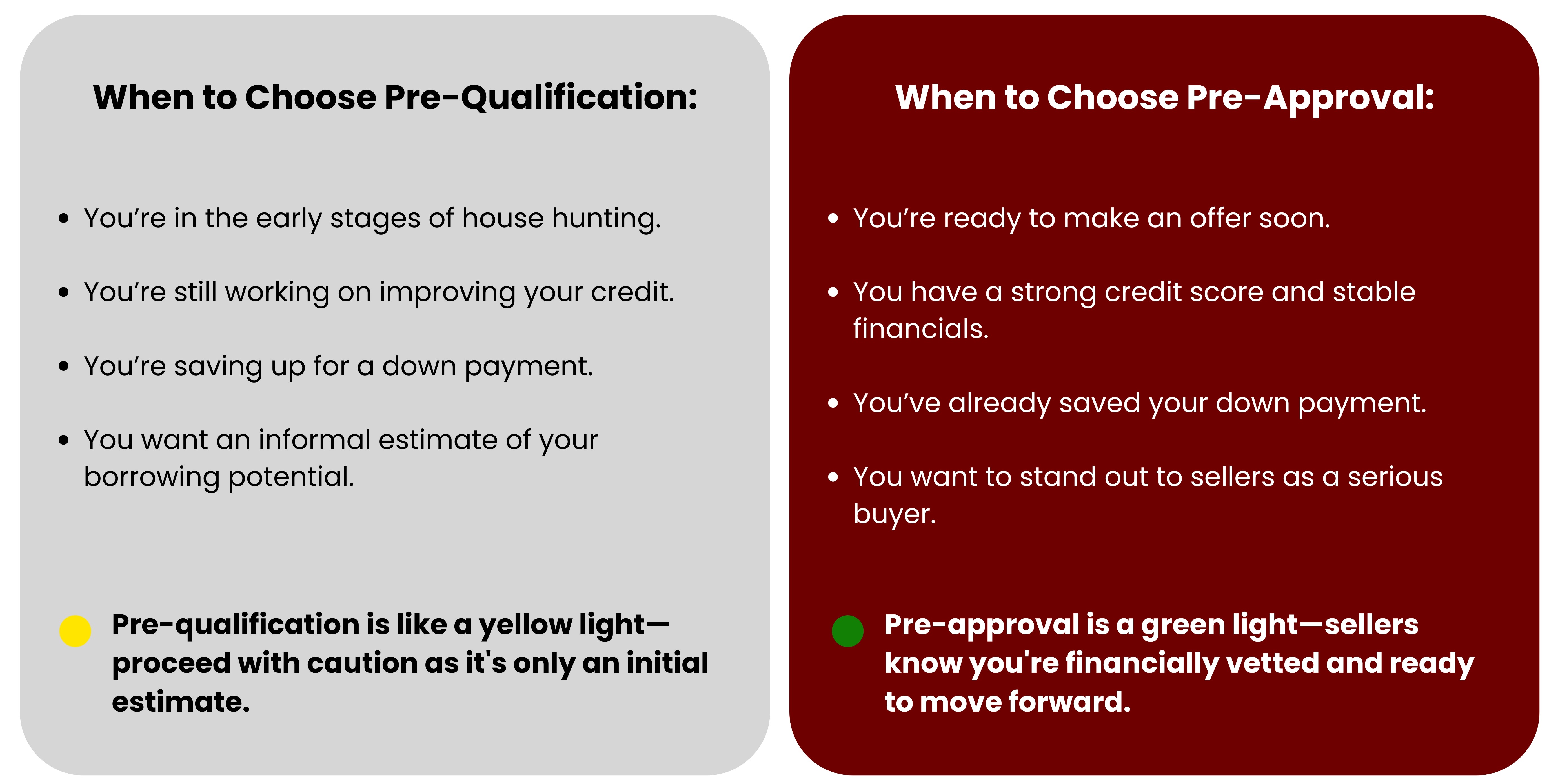

When deciding between pre-qualification and pre-approval, the right choice depends on where you are in your home buying journey. Pre-qualification is typically the first step for buyers who are just starting out. It offers a general sense of your potential borrowing capacity based on self-reported financial information. It’s useful if you're still improving your credit, building savings, or exploring home prices in your area. However, pre-qualification does not involve a credit check or verification of financial documents, so it carries less weight with sellers.

Pre-approval, on the other hand, is the go-to option when you're serious about making an offer. It involves a more thorough review, including a credit check and verification of income, assets, and employment. A pre-approval letter signals to sellers that you are financially prepared and qualified to purchase a home, an advantage in competitive markets. If you're ready to buy within the next few months, have a strong credit profile, and have already saved for a down payment, pre-approval is the smart next step.

Can I Get a Mortgage Pre-Approval at Mission San Jose Mortgage?

Absolutely. At Mission San Jose Mortgage, we provide a comprehensive range of resources to support you at every stage of the homebuying journey. Whether you're a first-time buyer, beginning the pre-approval process, or exploring your mortgage options, our experienced team is here to guide you every step of the way. If we receive all the necessary documents and your credit report, we can typically issue a pre-approval within just 2 to 3 hours.

Be sure to take advantage of our online mortgage calculators to estimate payments and determine what you can afford.

Ready to get started? Let our expert mortgage team and loan officers help you take the next step toward homeownership with confidence.