Non-QM Loans: How to Get a Mortgage Without Traditional Income Verification

| July 03 2025

| Published by MSJ Mortgage

For many aspiring homeowners, qualifying for a traditional mortgage can feel like hitting a wall especially if you're self-employed, rely on investment income, or have unique financial circumstances. The good news? Traditional income verification isn’t the only path to homeownership. At Mission San Jose Mortgage, we understand that not all borrowers fit into the same financial mold. That’s why we specialize in Non-QM (Non-Qualified Mortgage) solutions, flexible loan programs designed for people with unconventional income streams or complex financial profiles.

Whether you're a business owner with strong cash flow but limited W-2s, a retiree with significant assets, or simply someone who needs an alternative to rigid lending guidelines, Non-QM loans may open the door to financing that works for you. In this blog, we’ll walk you through how these loans work, who they’re best suited for, and how Mission San Jose Mortgage can help you navigate the process with confidence.

What Are Non-QM Loans?

A Non-Qualified Mortgage (Non-QM) is a home loan designed for borrowers who don’t meet the strict guidelines of a Qualified Mortgage (QM) as defined by the Consumer Financial Protection Bureau (CFPB). These guidelines were created to promote safe lending practices by limiting risky loan features such as interest-only payments or balloon payments and requiring lenders to verify a borrower’s ability to repay through traditional income documentation like W-2s and pay stubs.

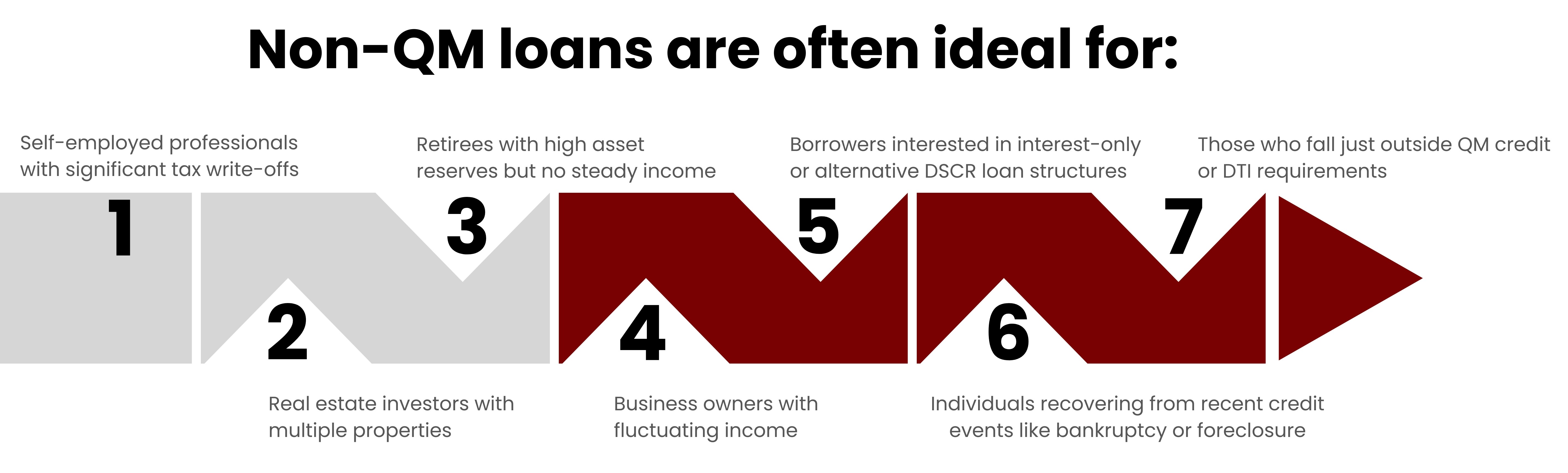

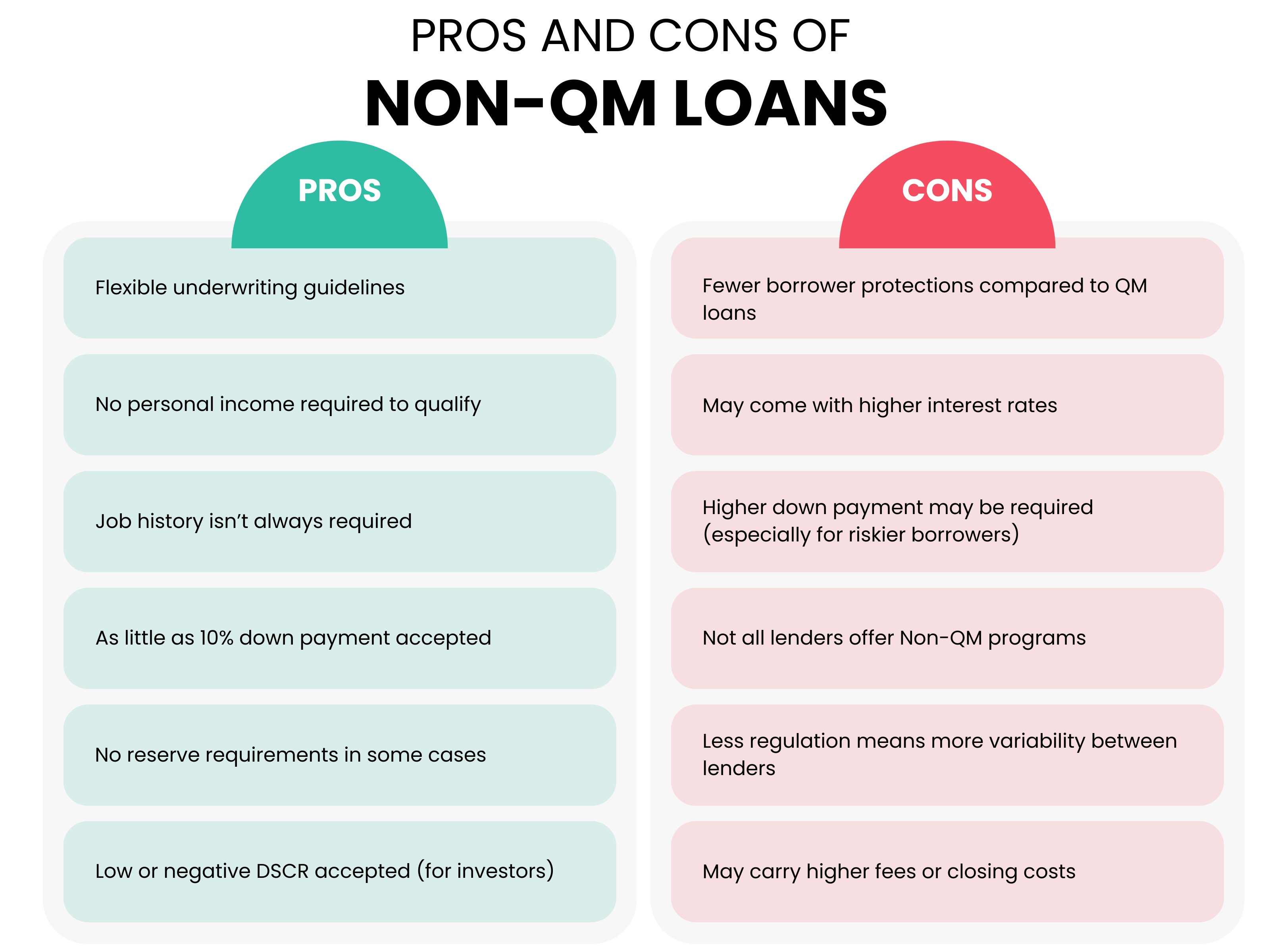

But not all borrowers fit into those boxes. That’s where Non-QM loans come in. These loans offer more flexible underwriting criteria and are ideal for individuals with non-traditional income, such as self-employed professionals, real estate investors, retirees, or those recovering from credit events like bankruptcy or foreclosure.

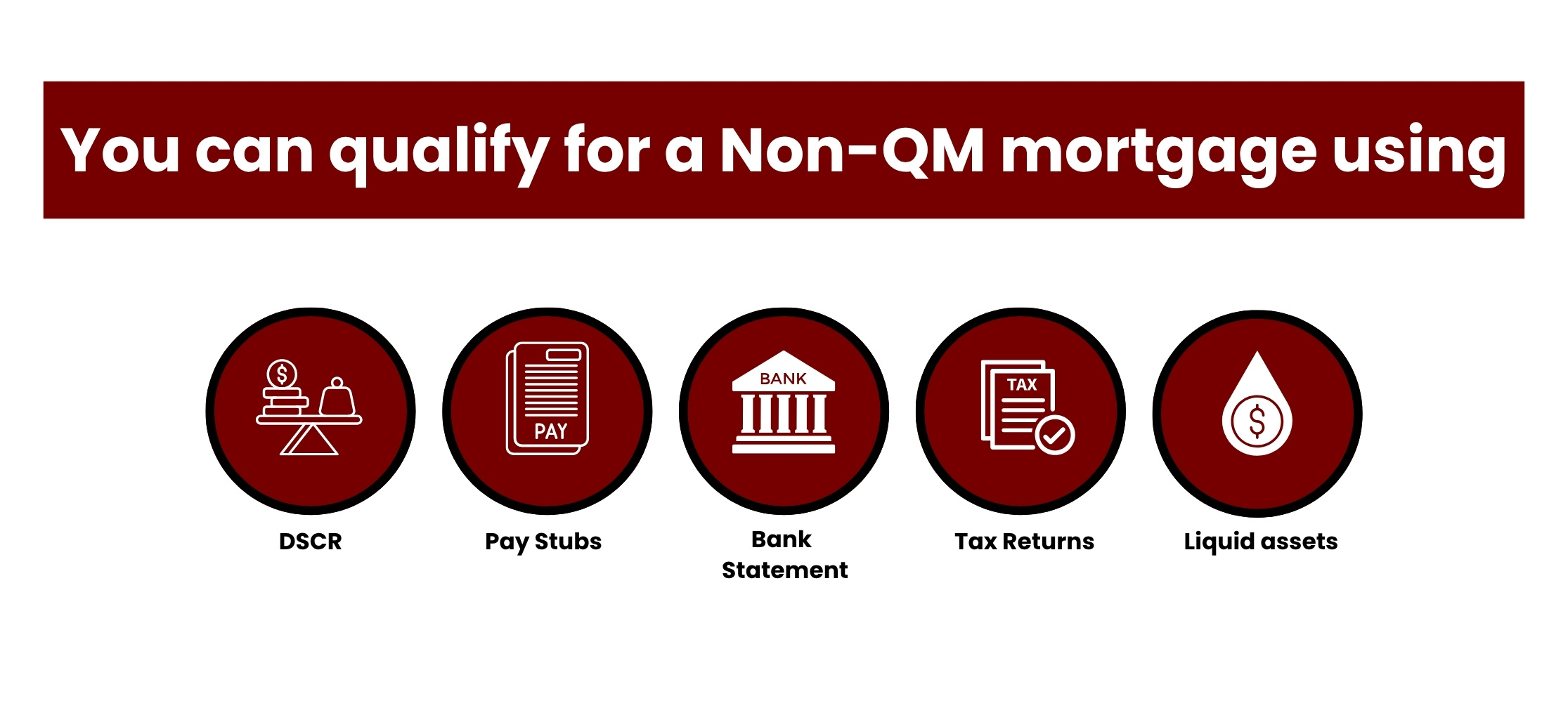

Instead of relying solely on tax returns or employment records, Non-QM lenders often accept bank statements, 1099s, rental income, or asset depletion strategies to verify income. Debt-to-income (DTI) limits are also more relaxed, sometimes going as high as 50% and credit requirements are generally more forgiving

Non-QM vs. Qualified Mortgage

While most borrowers are familiar with Qualified Mortgages (QM) the standard loans backed by government-sponsored entities like Fannie Mae, Freddie Mac, FHA, VA, and USDA fewer know about the alternative: Non-Qualified Mortgages (Non-QM). These loans don’t follow the Consumer Financial Protection Bureau’s (CFPB) strict QM guidelines but offer flexibility for borrowers who fall outside conventional criteria.

What Are Qualified Mortgage Requirements?

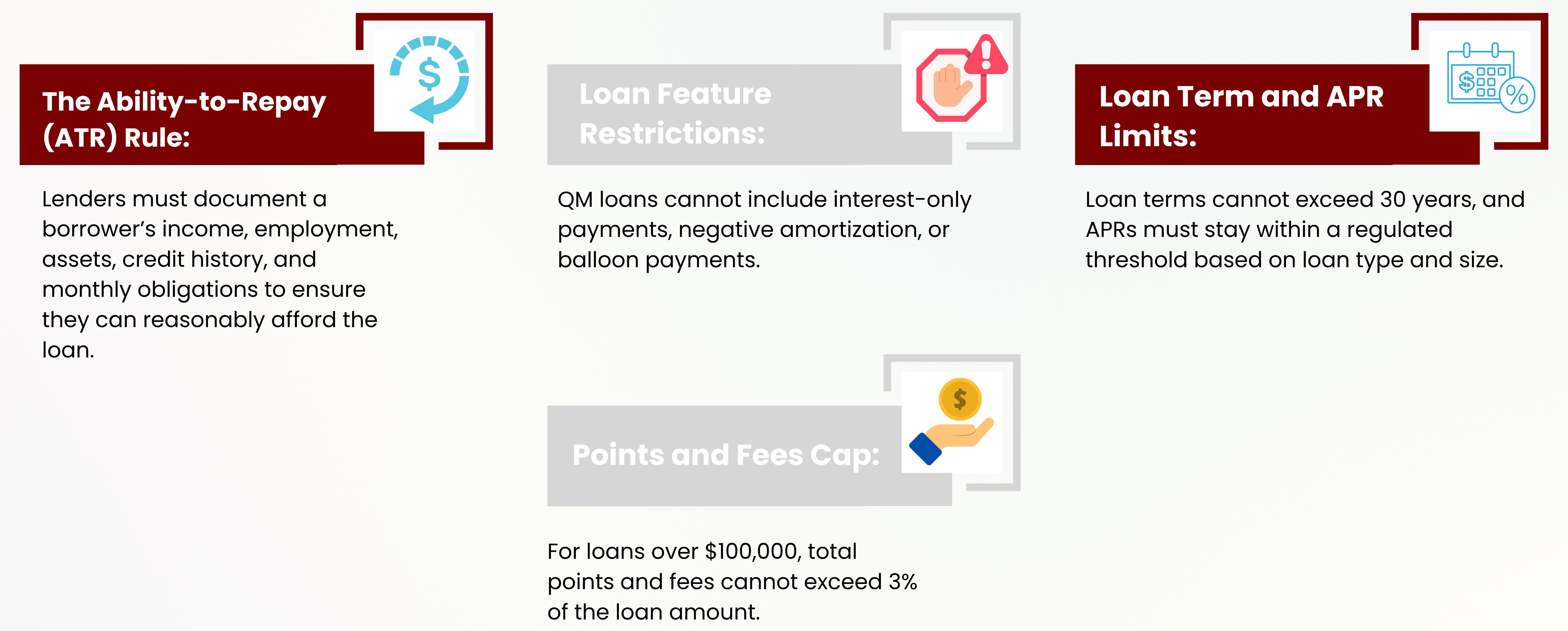

Qualified Mortgages were introduced in 2014 as part of post-recession reforms. They aim to reduce risky lending and protect borrowers from loans they can’t afford. To meet the CFPB’s standards, a QM loan must include the following features:

These protections were designed to prevent the type of widespread loan defaults that contributed to the 2008 financial crisis. But while these rules are well-intentioned, they can be too restrictive for borrowers with unconventional financial profiles.

Why Consider a Non-QM Mortgage?

Not every qualified borrower has W-2 income or perfect credit. At Mission San Jose Mortgage, we understand that financial strength isn’t always shown on paper in the same way. If you‘re self-employed, own multiple properties, or rely on seasonal or investment income, a Non-QM loan could be a better fit.

If you’ve been turned away from a conventional mortgage, or you‘re just not sure where you fit in the traditional mold, Mission San Jose Mortgage can help. Our team specializes in Non-QM lending solutions and can guide you toward a product that aligns with your financial situation and goals.

How to Apply for a Non-QM Loan with Mission San Jose Mortgage?

Applying for a Non-QM loan through Mission San Jose Mortgage is straightforward, and our team is here to guide you every step of the way. Here‘s how the process works:

Step 1: Initial Consultation

Your dedicated loan officer will review your financial situation and recommend Non-QM loan options that align with your goals along with available rates and terms.

Step 2: Submit Your Loan Application

You can complete the application securely online or over the phone whichever is more convenient for you.

Step 3: Rate Lock

Once you’ve chosen the loan terms, we’ll lock in your interest rate over the phone to secure your pricing.

Step 4: Review and Sign Disclosures

We’ll send you the initial loan disclosures and application package electronically for your review and e-signature.

Step 5: Provide Supporting Documents

Submit the requested financial documents (such as bank statements, tax returns, or proof of assets) to support your loan file.

Step 6: Underwriting Begins

Your complete file will be submitted to underwriting, where your eligibility is formally reviewed.

Step 7: Appraisal and Inspections

We’ll coordinate a property appraisal and, if required, a termite inspection to assess the property‘s condition and value.

Step 8: Final Conditions

After conditional approval, we’ll reach out for any final items needed to complete your loan documentation.

Step 9: Final Review and Closing

You’ll go over your Closing Disclosure and settlement statement with your loan officer, then sign the final documents with a notary.

Step 10: Funding

Once everything is signed and approved, your loan will be funded bringing you one step closer to purchasing or refinancing your property.

Is a Non-QM Loan Right for You?

If you’ve struggled to qualify for a traditional mortgage due to your income type, credit history, or employment situation, a Non-QM loan could be the solution you’ve been looking for. Whether you‘re self-employed, own multiple investment properties, or have recently gone through a financial setback, Non-QM loans offer a flexible path to homeownership or refinancing without the rigid income and credit requirements of conventional loans.

At Mission San Jose Mortgage, we work with a wide range of Non-QM lenders to tailor loan solutions for real-life situations. If you write off too much on your taxes, rely on rental income, or simply don’t have W-2s to show, you‘re not out of options. We take the time to understand your full financial picture and match you with a loan that fits not one that forces you into a mold.

Still unsure if a Non-QM loan is right for you? Let’s talk. Our loan officers will assess your unique situation and walk you through all available options with honesty, transparency, and expertise. You may be closer to financing your next home or investment than you think.