How to Get a Mortgage Without Tax Returns: Bank Statement Loan Guide

| July 25 2025

| Published by MSJ Mortgage

Securing financing for your dream home can feel overwhelming, especially if you're self-employed, a contractor, or anyone relying on 1099 income. Traditional lenders often require W-2 forms and tax returns to verify earnings making it harder for independent workers to qualify for a mortgage.

At Mission San Jose Mortgage, we understand that many qualified buyers don‘t fit the standard mold. That‘s why alternatives like bank statement loans exist. Instead of tax returns, these loans use your recent bank deposits to prove your ability to repay.

In this guide, we‘ll explain what a bank statement is, how to obtain one, and how a bank statement loan can help you achieve homeownership even without employer-issued income documentation. Whether you‘re a freelancer, small business owner, real estate investor, or retiree, We are here to help you navigate this flexible mortgage option.

What Is a Bank Statement?

A bank statement is a monthly summary of your bank account activity, designed to help you track your finances and verify all transactions. It includes detailed records of every deposit and withdrawal made during the statement period, along with your account details.

Banks issue these statements regularly typically on the same day each month either by mail or electronically. They list transactions in chronological order, making it easy to see how money moved in and out of your account.

By reviewing these statements each month, you can monitor your spending habits, spot errors or fraud, and maintain better control over your finances.

How to Get a Bank Statement

Most banks offer online and mobile banking where you can quickly download your statements as PDF files. Simply log in, find the “Statements” or “Documents” section, and select the period you need.

If you prefer paper copies or can’t find them online, contact your bank to request mailed statements. Many banks also let you choose paperless delivery for added convenience and security.

What Is a Bank Statement Loan?

A bank statement loan is a flexible mortgage option designed for self-employed individuals and others who don’t receive traditional W-2s or pay stubs. Instead of relying on tax returns, lenders use your recent bank statements to verify your income.

These loans are classified as Non-QM (Non-Qualified Mortgage) products, offering an alternative path to homeownership for those with non-traditional income sources. Whether you‘re buying your first home or refinancing to tap into your equity, bank statement loans can make it easier to achieve your real estate goals even without submitting tax returns.

How Does a Bank Statement Loan Work?

Unlike traditional mortgages, bank statement loans don’t require tax returns, W-2s, or pay stubs. Instead, lenders review your checking or savings account statements to verify income and cash flow over time. This approach is ideal for self-employed borrowers with variable income.

While you skip the usual employment verification, you’ll still need to provide specific documents so the lender can evaluate your ability to repay the loan. Being prepared with all requirements upfront can make the approval process much smoother.

Collecting these details helps your lender build a strong case for your loan approval, ensuring you get the financing you need with fewer traditional barriers.

Types of Bank Statement Loans

Bank statement loans aren’t one-size-fits-all; they come in several forms designed to meet the needs of borrowers with non-traditional income. Whether you‘re purchasing a new home, refinancing your current mortgage, or accessing your home's equity, these options offer flexible solutions for self-employed professionals and independent workers.

● Bank Statement Purchase Loans Ideal for buyers without W-2s or pay stubs. Qualify for a new home based on consistent bank deposits instead of traditional income documents.

● Bank Statement Refinance Loans Refinance your existing mortgage by using your bank statements to verify income. Options include accessing home equity, lowering your interest rate, or adjusting loan terms.

● Bank Statement Home Equity Loans Tap into your home‘s built-up equity for major expenses or investments. Eligibility is based on your bank statements rather than tax returns.

● Profit and Loss (P&L) Loans Designed for business owners whose taxable income may understate true earnings. Qualify using professionally prepared P&L statements instead of tax returns.

● 1099 Loans A solution for independent contractors and gig workers. Use your 1099 income to prove your ability to repay without traditional W-2 documentation.

These flexible loan types help make homeownership and refinancing accessible to self-employed borrowers who don’t fit the traditional mold.

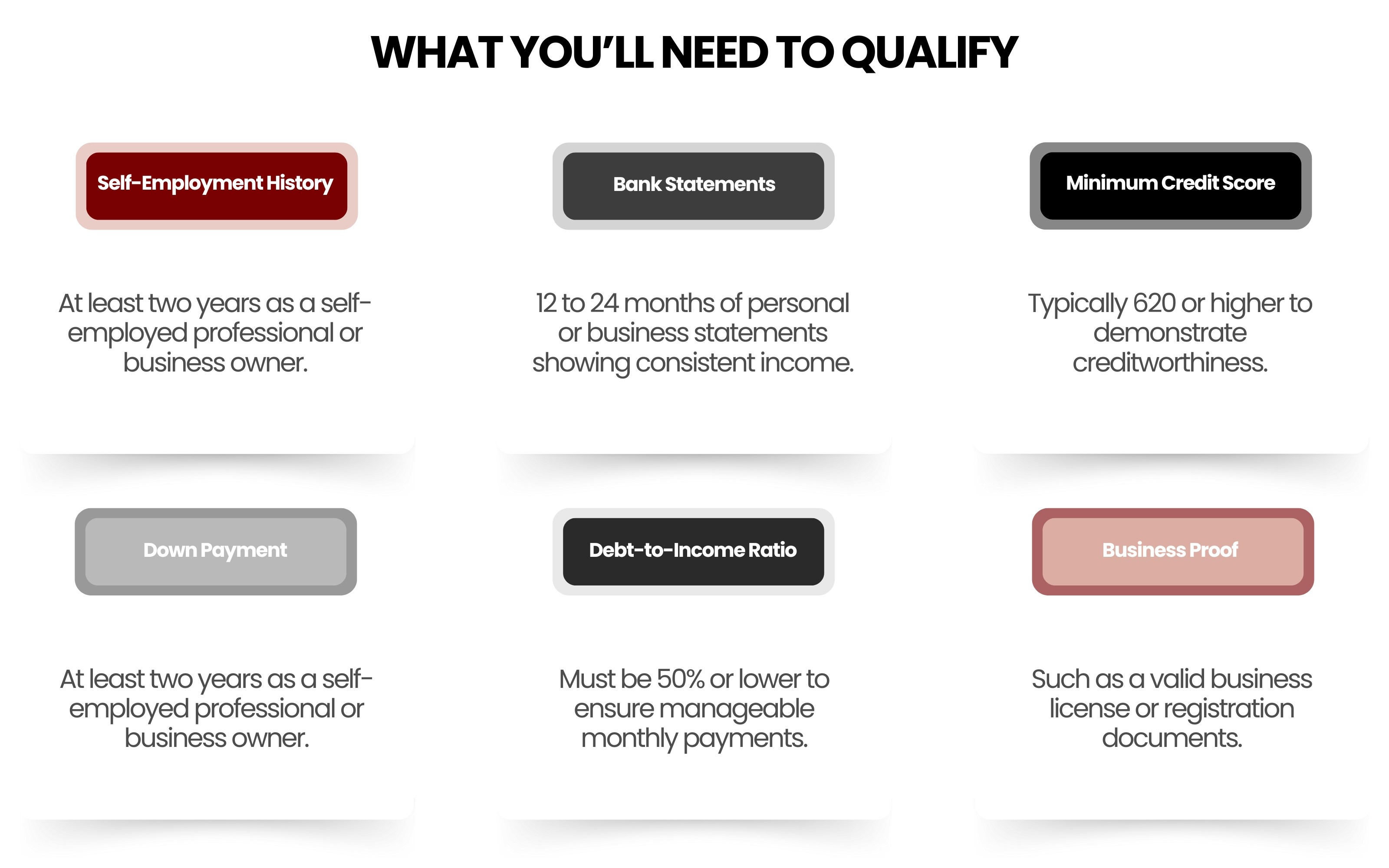

Bank Statement Loan Qualification Requirements

Unlike traditional mortgages that depend on W-2s or tax returns, bank statement loans use your bank deposits to verify income and determine eligibility. This approach is tailored for self-employed individuals and business owners with non-traditional income documentation.

Meeting these criteria helps demonstrate your ability to repay, even without traditional employment verification.

Understanding the 28/36% Rule

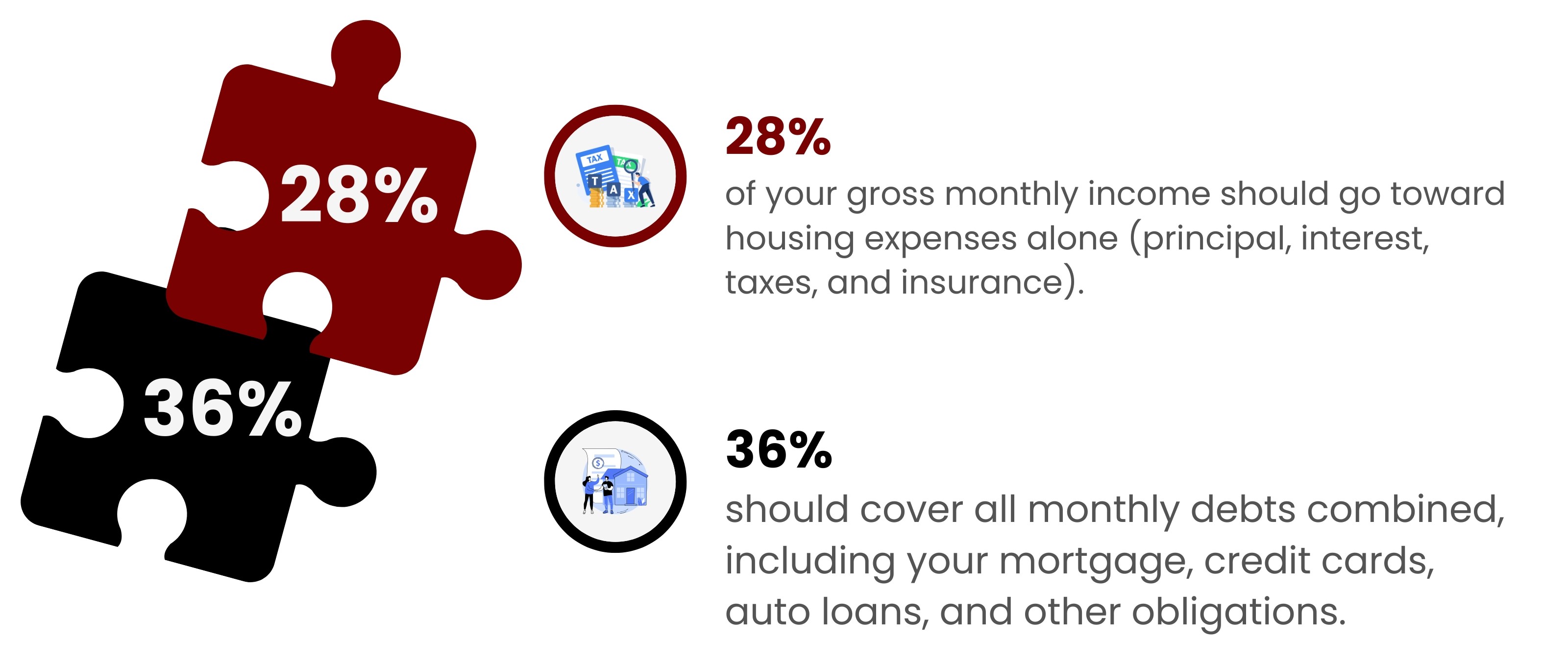

Your debt-to-income (DTI) ratio is a key factor lenders use to evaluate whether you can comfortably afford your mortgage payments. It compares your monthly debt obligations to your gross monthly income, helping determine your borrowing capacity.

While lender requirements can vary, a common guideline is the 28/36% rule:

By keeping your DTI within these limits, you demonstrate to lenders that you can manage your mortgage responsibly without overextending your finances. Even though some bank statement loan programs allow higher DTI ratios (often up to 43–50%), the 28/36% rule remains a helpful benchmark for borrowers aiming for financial stability.

Benefits of a Bank Statement Loan

Bank statement loans provide a flexible financing option for self-employed professionals, freelancers, and business owners with non-traditional income. Instead of relying on W-2s or tax returns, these loans use your actual bank deposits to verify income, making them more accessible to independent earners.

Here are some of the key benefits:

● Qualify with Bank Statements Borrowers can use 12 to 24 months of personal or business bank statements to demonstrate income instead of traditional documentation.

● High Loan Limits Many bank statement loan programs offer higher financing limits, with some allowing borrowing up to $20 million for qualified applicants.

● Low Down Payment Options Qualified borrowers may secure financing with as little as 10 percent down, making homeownership more attainable.

● Eligible for Vacation and Investment Properties These loans can be used not only for primary residences but also for second homes and investment properties.

● Streamlined Application Process Often simpler and faster than conventional loans, especially when working with experienced lenders who specialize in non-QM products.

● Flexible Qualification Standards Typically more accommodating for borrowers with lower credit scores compared to traditional mortgage requirements.

Bank statement loans are designed to meet the needs of independent professionals and entrepreneurs who need a more adaptable path to homeownership.

Final Thoughts

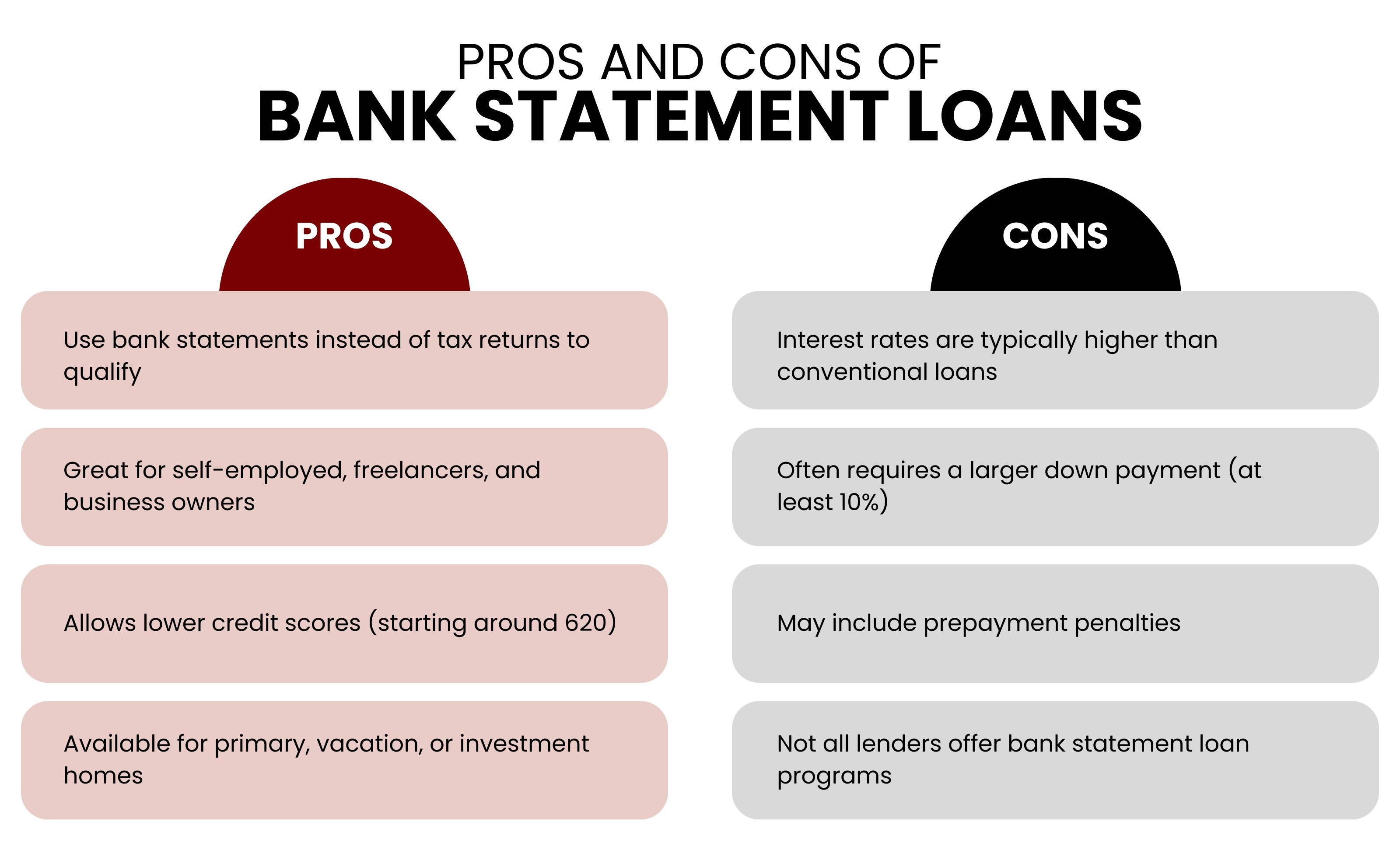

Bank statement loans offer a valuable alternative for self-employed borrowers, freelancers, and business owners who don’t fit traditional lending requirements. By using bank deposits instead of tax returns or W-2s to verify income, these loans provide a flexible path to homeownership and real estate investment.

While they come with benefits like higher loan limits, broader property options, and more accessible credit requirements, it’s important to consider potential trade-offs. These can include higher interest rates, larger down payments, and possible prepayment penalties.

If you’re exploring your mortgage options and think a bank statement loan might be right for you, take the time to understand the requirements, evaluate your budget, and choose a lender experienced in non-QM products. With the right preparation, you can unlock financing tailored to your unique income situation and move one step closer to your dream home.

At Mission San Jose Mortgage, we‘re committed to helping self-employed borrowers navigate their options with confidence. Reach out today to learn more about whether a bank statement loan is the right fit for you.