FHA Loans Made Simple: A Homebuyer’s Guide for 2025

| May 02 2025

| Published by MSJ Mortgage

At Mission San Jose Mortgage, we understand that buying a home especially for the first time can feel overwhelming. That's why we're here to simplify the process by helping you explore your options, including FHA loans.

What Is an FHA Loan?

An FHA loan is a type of home loan thats backed by the Federal Housing Administration, which is part of the U.S. government. The FHA doesn't lend you the money directly. Instead, it helps by insuring the loan, so if something goes wrong, the lender has some protection. That makes lenders more comfortable helping people who may not have perfect credit or a big down payment saved up.

FHA loans are known for being flexible and more forgiving when it comes to things like credit scores and income. That's why they're especially helpful for first-time buyers or people who are starting over financially. They let you buy a home with less money upfront and give you a chance even if your credit isn't the best.

A Legacy of Helping Homebuyers for Nearly 100 Years

The FHA was established in 1934 as part of President Franklin Roosevelt's New Deal to help Americans during the Great Depression, a time when buying a home was incredibly difficult. Since its creation, the FHA and its network of approved lenders have insured nearly 50 million mortgages, making homeownership possible for millions of families.

Different Types of FHA Loans

The Federal Housing Administration (FHA) offers several loan programs designed to meet a variety of homebuying and home improvement needs. Heres a breakdown of the most common FHA loan types:

Standard FHA Loan (203b)

The most popular option, used to purchase or refinance a home with as little as 3.5% down. Its ideal for first-time buyers or those with lower credit scores.

FHA 203(k) Rehabilitation Loan

Allows you to buy a fixer-upper or improve your existing home by rolling renovation costs into your mortgage. Great for properties that need repairs or upgrades.

FHA Energy Efficient Mortgage (EEM)

Adds extra funds to your mortgage for energy-saving improvements like insulation, solar panels, or energy efficient windows.

FHA Graduated Payment Mortgage (245a)

Starts with lower monthly payments that gradually increase over time best for buyers who expect their income to grow.

FHA Construction-to-Permanent Loan

Helps borrowers finance the construction of a new home, converting into a standard mortgage once the build is complete.

Title 1 Home Improvement Loan

Used to finance essential repairs or improvements, such as roofing, plumbing, or accessibility modifications.

FHA Reverse Mortgage (HECM)

Available to homeowners aged 62 or older. This loan allows you to convert part of your home equity into cash without selling your home.

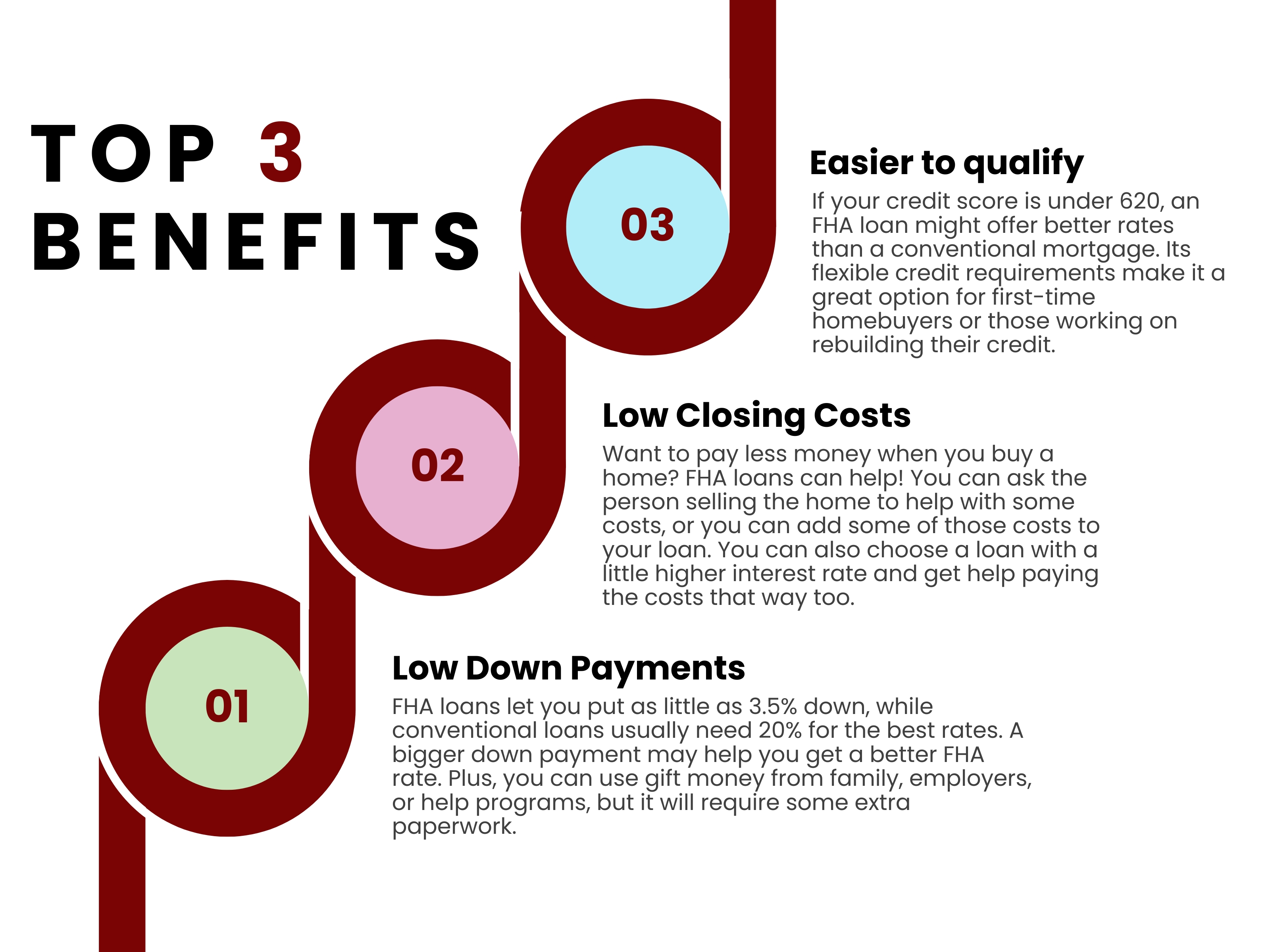

Why Choose an FHA Loan?

Why an FHA Loan Might Be Right for You in 2025

In 2024, nearly one in five homebuyers in the U.S. used an FHA loan, a clear sign of how valuable this option has become. As we head into 2025, FHA loans remain a strong choice for buyers who may not meet the stricter criteria of conventional loans. Whether you’re purchasing your first home, rebuilding after financial setbacks, or simply looking for a more accessible path to homeownership, FHA loans can help you get started.

Managed by the Department of Housing and Urban Development (HUD), the FHA loan program is specifically designed to expand access to homeownership. It comes with its own guidelines, insurance requirements, and benefits all of which we’ll help you understand clearly.

At Mission San Jose Mortgage, we guide you through the entire process from understanding how much you can borrow, to comparing FHA and conventional options, to meeting the qualification criteria. Think of us as your home loan coach here to make sure you move forward with confidence and clarity.

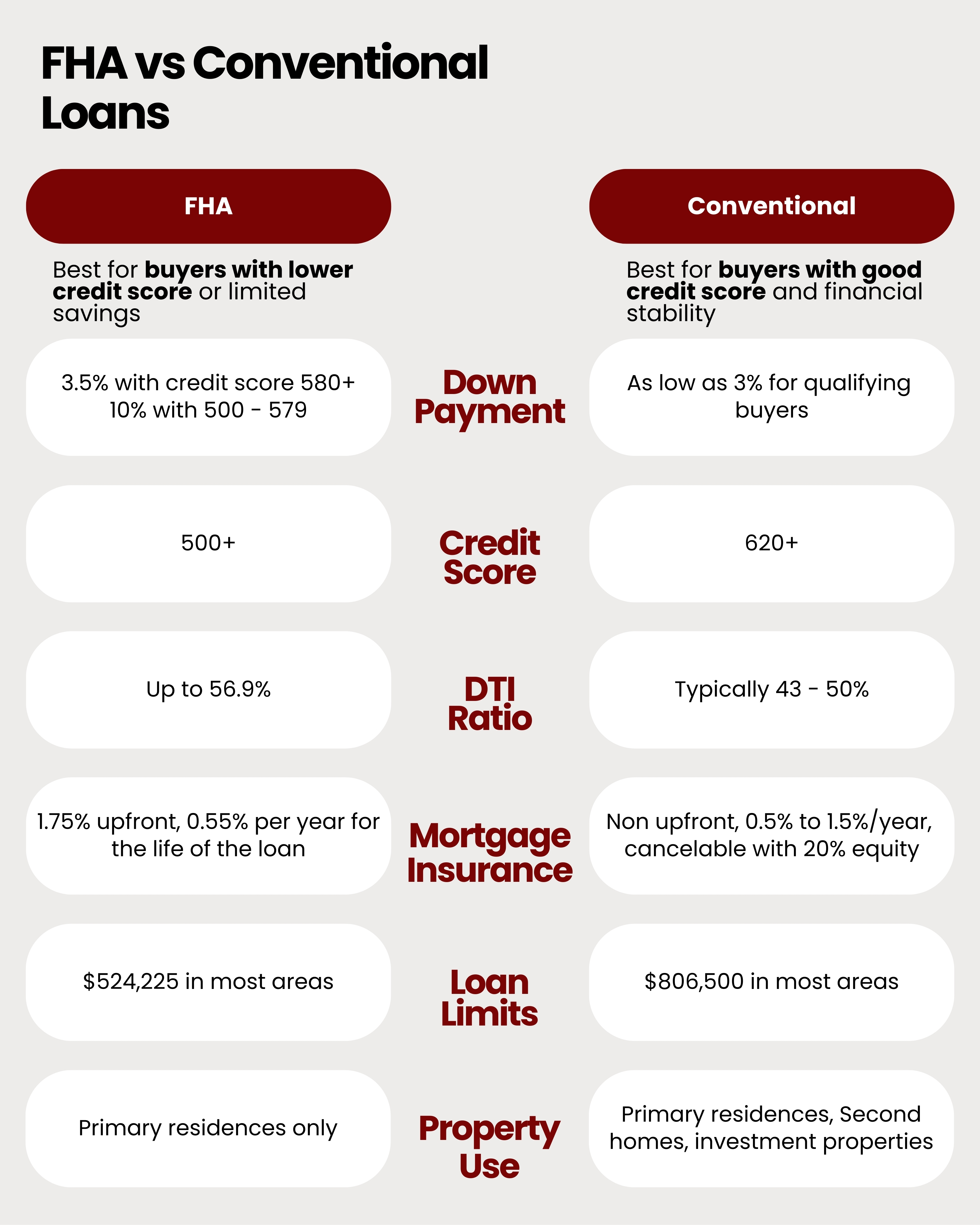

FHA vs. Conventional Loans: What’s the Difference?

FHA loans are government-backed, allowing lower credit scores (down to 500) and small down payments (3.5%), but require long-term mortgage insurance. Conventional loans, not government-backed, need better credit (620+) but let you drop PMI at 20% equity. FHA suits buyers with weaker credit; conventional works best for strong borrowers.

Common Myths About FHA Loans Debunked

FHA loans are only for people with bad credit.

Not true! While FHA loans are helpful for those with lower credit scores (as low as 500 with 10% down or 580 with 3.5% down), many borrowers have good credit (600+ and above).

FHA loans only work for single-family homes.

Nope! You can use an FHA loan to buy a duplex, triplex, or fourplex and rent out the extra units as long as you live in one of them.

Only first-time buyers can use FHA loans.

Wrong! You can use an FHA loan multiple times, as long as the property is your primary residence.

You need a W-2 job to qualify.

Not at all! Self-employed? Receiving disability or child support? As long as you can document your income, you may qualify.

FHA mortgage insurance never goes away.

If you put 10% or more down, it drops after 11 years. If you put less down, you can refinance into a conventional loan later to remove it

If one lender says no, they all will.

Not true! Different lenders have different requirements. Shop around, some are more flexible than others.

FHA loans take forever to close.

They can close just as fast as conventional loans unless the property needs repairs.

FHA appraisals are too strict.

They mainly ensure the home is safe and livable. Most homes pass without issues.

FHA has the lowest down payment.

Actually, VA and USDA loans offer 0% down, and some conventional loans require as little as 3%.

FHA interest rates are always higher than conventional.

Not necessarily. FHA rates are often lower for buyers with credit scores below 680.

You can’t get an FHA loan if you earn too much.

There are no income limits, high earners can qualify too.

Student loans automatically disqualify you.

Not anymore! Lenders use your actual monthly payment or 0.5% of your loan balance to calculate affordability.

Bankruptcy means you can’t get an FHA loan.

You can qualify two years after a Chapter 7 discharge or one year into Chapter 13 repayment (with court approval).

Foreclosure disqualifies you.

You may qualify again after three years, sometimes sooner in cases of hardship like a family death or illness.

FHA mortgage insurance is always more expensive.

Not always. In some cases, FHA insurance is cheaper than conventional PMI so it’s worth comparing both.

You can’t refinance an FHA loan.

Yes, you can! FHA Streamline Refinance lets you lower your rate with minimal paperwork no appraisal or credit check required.

Sellers don’t accept FHA loans.

Some prefer conventional offers, but many accept FHA especially when buyers are pre approved and working with a solid agent.

Do You Qualify for an FHA Loan?

Now that you're familiar with the benefits and types of FHA loans, how they stack up against other options, and the truth behind common myths, you might be wondering do you qualify? Let’s break down the key requirements.

FHA Loan Requirements: What You Need to Know

Qualifying for an FHA loan is typically more accessible than securing a conventional mortgage, but you must still meet specific criteria established by both the Federal Housing Administration and your chosen lender.

Credit Score Requirements

The FHA sets a minimum credit score of 500, but individual lenders often require higher scores (known as `' overlays `'). While some lenders accept scores as low as 580 for the best terms, others may require at least 620.

Income and Debt Guidelines

Mortgage Payment to Gross Income Ratio

This ratio determines how much of your pretax income can go toward your mortgage payment.

For FHA loans, your total monthly housing costs (including principal, interest, property taxes, homeowners insurance, and other related expenses) must not exceed 31% of your gross income.

Debt-to-Income Ratio (DTI)

Lenders also evaluate your total monthly debt obligations (mortgage, car loans, credit cards, etc.) compared to your income.

Your DTI should generally stay below 43%, though exceptions may apply with strong compensating factors.

Property Usage Rules

FHA loans are designed for primary residences only. They cannot be used for:

● Vacation home

● Second homes

● Investment or rental properties

Down Payment Requirements

Your minimum down payment depends on your credit score:

● 580 or higher: 3.5% down

● 500-579: 10% down

● Gift funds from family, employers, or approved down payment assistance programs can be used to cover this cost.

Proof of Stable Income

To show you can afford monthly payments, your lender will ask for proof of steady income. This can come from a job, self-employment, social security, pensions, or child/spousal support.

FHA Loans in the Homebuying Process

Purchasing your first home can feel overwhelming, especially when navigating government-backed loan programs. FHA loans offer an accessible path to homeownership, but they come with unique requirements regarding mortgage insurance and property standards that buyers should understand.

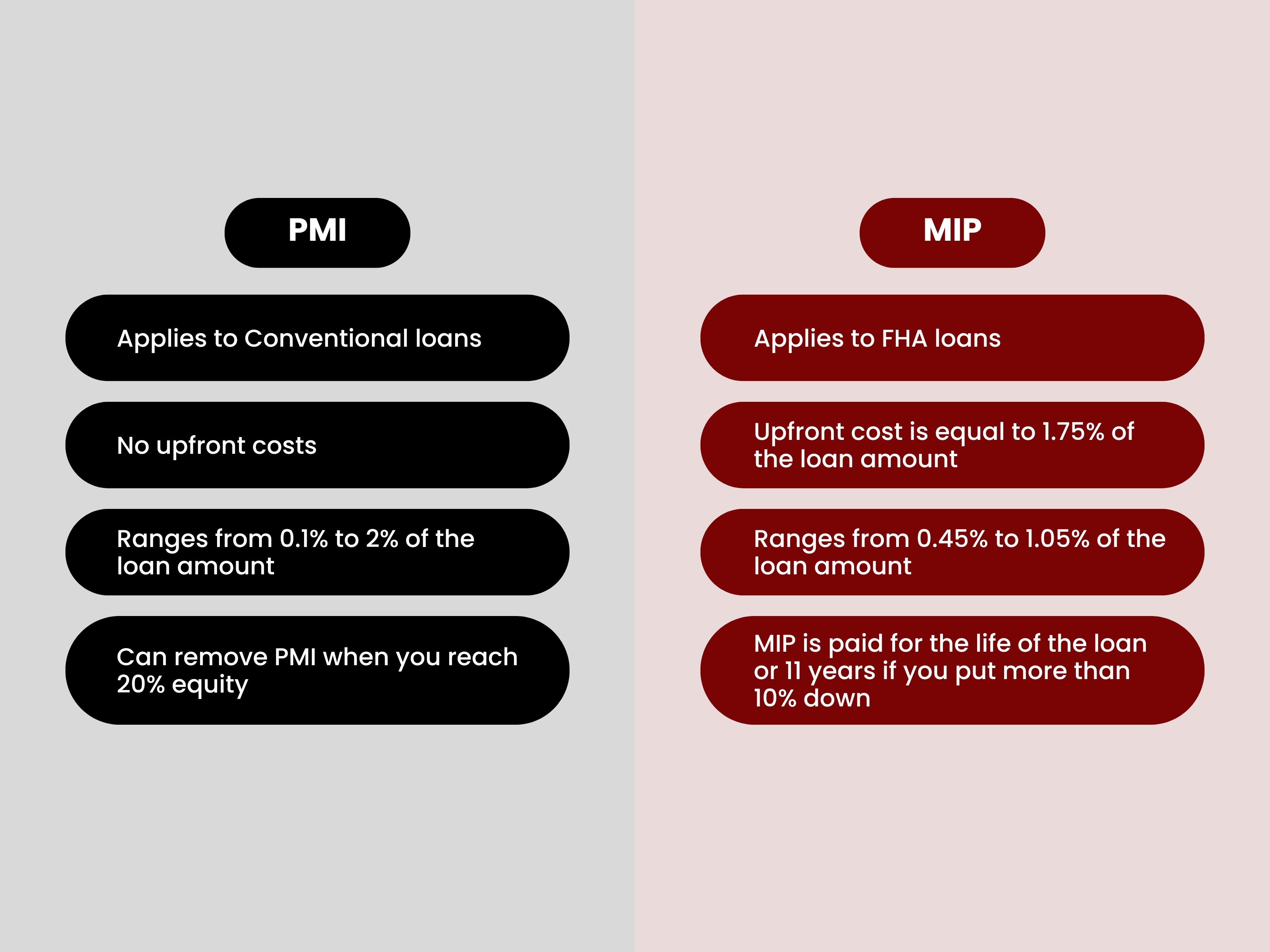

Mortgage Insurance: PMI vs. MIP

Mortgage insurance protects lenders if borrowers default on their loans. While conventional loans require Private Mortgage Insurance (PMI) for down payments below 20%, FHA loans use Mortgage Insurance Premium (MIP) instead.

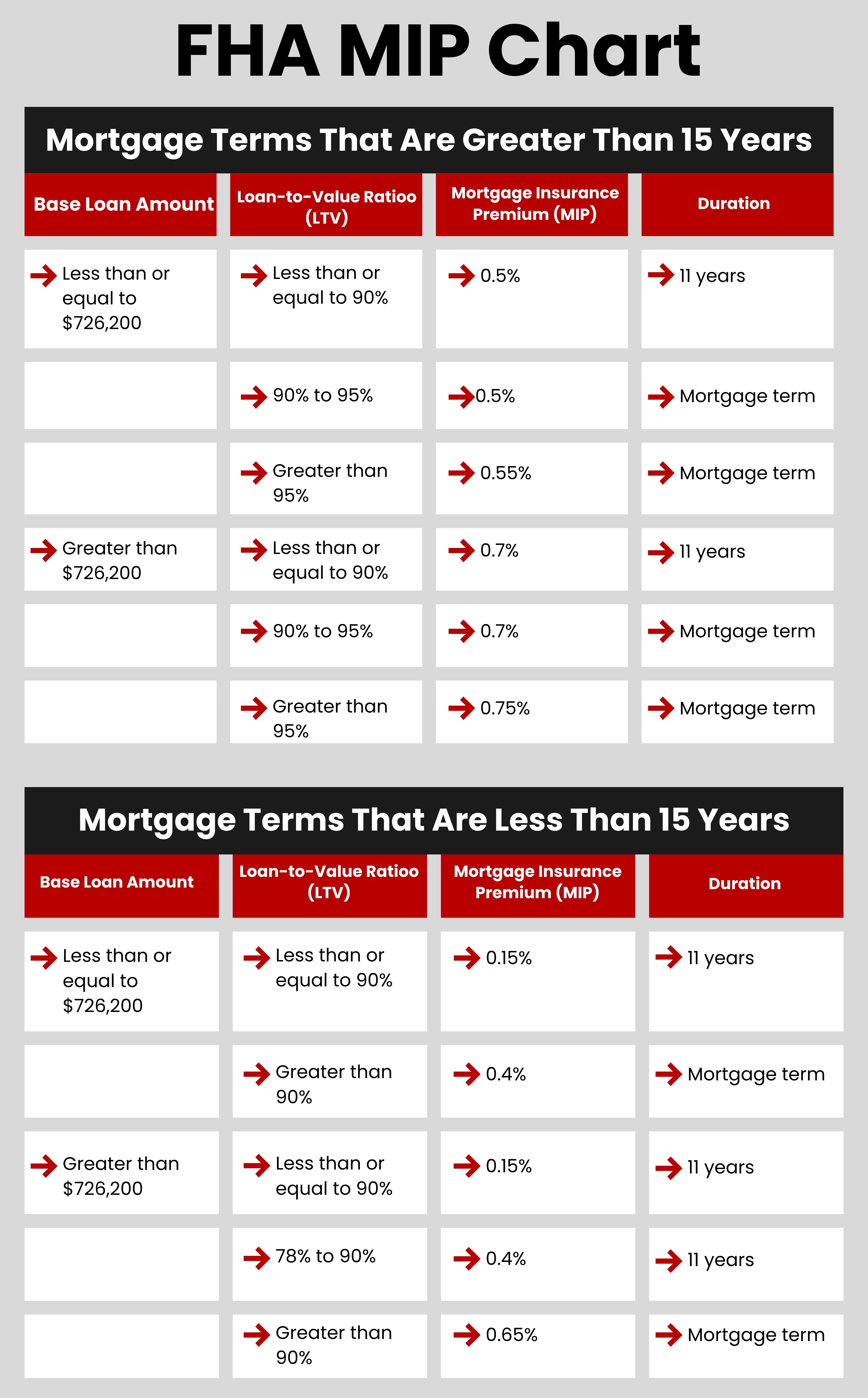

FHA loans have two types of mortgage insurance:

Upfront Mortgage Insurance Premium (UFMIP): A one-time fee (typically 1.75% of the loan amount) paid at closing or rolled into the loan.

Annual MIP: A recurring monthly cost included in your mortgage payment, which varies based on loan term, amount, and down payment.

FHA Property Guidelines and Requirements

When using an FHA loan, there are certain rules about the type of home you can buy. One of the most important is the primary residence requirement; this means the home must be the one you plan to live in. You can’t use an FHA loan to buy a vacation home, second home, or rental property you don’t live in.

Here’s what you can buy with an FHA loan:

● A single-family home

● An FHA-approved condominium

● An FHA-approved manufactured home

● A multifamily property (up to four units), as long as you live in one of the units yourself

In addition to the property type, the home must meet certain quality standards. An FHA-approved appraiser will inspect the property to ensure it meets the FHA’s minimum standards for safety, structural soundness, and general livability. This is to protect both you and the lender by making sure the home is a good, safe place to live.

So while FHA loans offer more flexibility in financing, the property itself must meet the program’s guidelines.

Refinancing Your FHA Loan

At some point, you may want to refinance your FHA loan to get a better interest rate, lower your monthly payments, or change the loan term. If you already have an FHA loan, you might qualify for a special option called an FHA Streamline Refinance.

Benefits of an FHA Streamline Refinance

● Quicker process with less paperwork than a regular refinance

● Access to better rates and terms compared to a conventional refinance

● Two options available:

Credit-qualifying (requires income and credit verification)

Non-credit-qualifying (faster, with fewer checks)

Important Things to Know

● Costs still apply: You’ll pay closing costs like the upfront mortgage insurance premium (UFMIP), title fees, and possibly escrow account fees. These can be paid out-of-pocket, rolled into the loan, or covered by accepting a slightly higher interest rate.

● You’ll still pay monthly MIP (Mortgage Insurance Premium): Refinancing with an FHA streamline doesn’t remove MIP. If your credit score is 620 or higher, you may consider refinancing into a conventional loan to eliminate MIP—but that’s optional.

● No cash-out: FHA streamline refinances are not for pulling equity out of your home. You can only receive up to $500 back at closing.

● Zero cost offers aren't free: Some lenders promote “zero cost” refinancing, but those costs are usually rolled into the loan or result in a higher interest rate—so always read the fine print.

How to Get Started

To qualify, your refinance must offer a “net tangible benefit” meaning it should clearly improve your financial situation. Your lender will review your current loan, compare it to the new terms, and provide an estimate of costs so you can decide if refinancing makes sense for you.

Is an FHA Loan the Right Choice for Your Home Purchase?

Understanding Your Mortgage Options

Throughout this blog, we've explored the key features of FHA loans, including their flexible qualification requirements, mortgage insurance structure, and property guidelines. Now, let's help you determine whether this government-backed mortgage program aligns with your homebuying goals and financial situation.

When an FHA Loan Might Not Be Ideal

An FHA loan may not be your best option if you have excellent credit (typically a FICO score above 720), as you could qualify for more competitive conventional loan terms with lower overall costs. Similarly, if you have sufficient savings for a 20% down payment, you could avoid mortgage insurance entirely with a conventional loan. The program also isn't suitable for purchasing investment properties, vacation homes, or luxury properties that exceed FHA loan limits in your area.

When an FHA Loan Makes Perfect Sense

FHA loans truly shine for buyers who need more flexible qualifying criteria. This includes first-time homebuyers with limited savings, as the program allows down payments as low as 3.5% for those with credit scores of 580 or higher (or 10% for scores between 500-579). The ability to use gifted funds from family members or approved assistance programs for your down payment makes homeownership accessible even if you haven't been able to save aggressively. Self-employed borrowers or those with non-traditional income sources may also find FHA's documentation requirements more accommodating than conventional loans.

Making Your Decision With Confidence

While no single mortgage product is perfect for every buyer, FHA loans have helped millions of Americans achieve homeownership when conventional financing wasn't an option. At Mission San Jose Mortgage, we specialize in helping buyers like you evaluate all available options and choose the mortgage solution that best fits your financial picture and homeownership timeline. Our loan officers can walk you through a detailed comparison of FHA versus conventional loans, helping you understand the long-term costs and benefits of each.

Frequently Asked Questions (FAQ)

Yes. FHA loans are designed to be flexible. You can qualify with a credit score as low as 580 with 3.5% down, or 500 with 10% down. Many lenders, however, may require slightly higher scores.

No. FHA loans are available to anyone purchasing a primary residence, whether it's your first home or not. You can even use an FHA loan multiple times, as long as the home will be your primary residence.

It depends on your credit score:

580 or higher: 3.5% down

500-579: 10% down

Gift funds from family or down payment assistance programs can also be used.

You can use an FHA loan to purchase:

A single-family home

An FHA-approved condo

A manufactured home

A 2-4 unit multifamily property, as long as you live in one of the units

Vacation homes and investment properties do not qualify.

It can, but it depends:

If you put 10% or more down, the mortgage insurance (MIP) drops after 11 years.

If you put less than 10% down, it stays for the life of the loan unless you refinance into a conventional mortgage later.

FHA loans can close just as fast as conventional loans typically within 30 days unless the home requires major repairs flagged during the appraisal.

Yes. The FHA Streamline Refinance program lets you refinance with less paperwork, no appraisal, and no credit check in many cases. It's a great way to lower your rate or monthly payment.