Bridge Loans: A Smart Move or Too Risky?

| July 11 2025

| Published by MSJ Mortgage

If you’re trying to buy a new home while still owning your current one, you already know the struggle of low housing inventory, rising prices, and sellers unwilling to accept contingent offers can make the timing feel nearly impossible. This is especially true in competitive markets like Silicon Valley, where the pace is relentless and the pressure to act quickly is real. For many homeowners, the question becomes: How do I buy before I sell without derailing my finances?

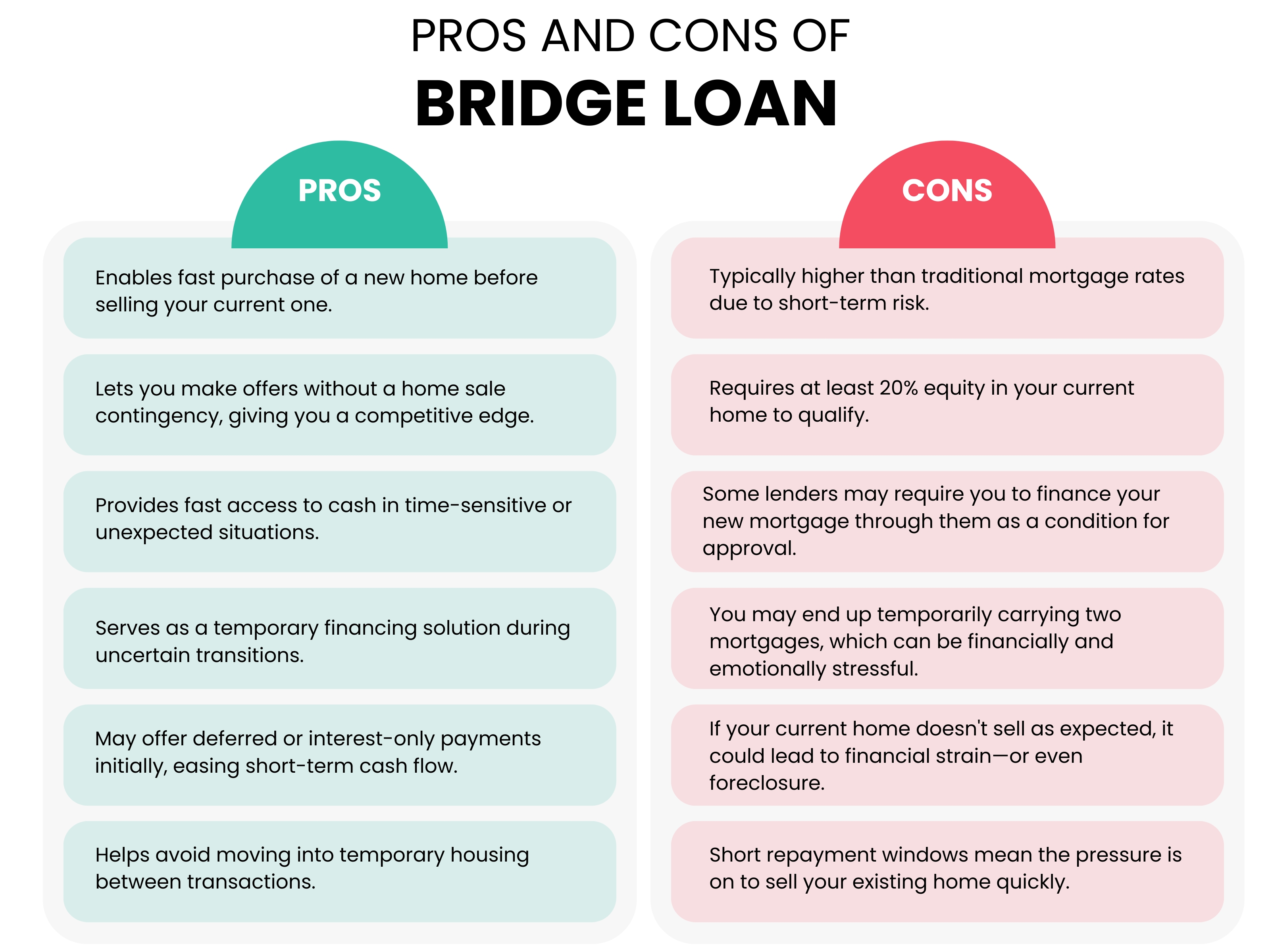

That’s where bridge loans come in. At Mission San Jose Mortgage, we’ve helped countless clients use this strategic tool to confidently transition from one home to the next without feeling squeezed. But bridge loans aren’t for everyone; they can be a smart solution or a risky move, depending on your situation. In this blog, we’ll walk you through exactly how they work, when they make sense, and the risks you need to be aware of so you can make a fully informed decision.

What Is a Bridge Loan?

A bridge loan is a short-term financing option—usually lasting 6 to 12 months—designed to help homeowners transition from one property to another. It allows you to access the equity in your current home before it’s sold, giving you the funds needed to purchase a new home without waiting for your existing property to close.

Bridge loans are especially useful in fast-paced markets where contingent offers aren’t accepted or timing is tight. Common situations include job relocations, quick move-in requirements, or securing a new home before listing your current one. They serve as a financial “bridge” to help you move forward without disruption.

How Does a Bridge Loan Work?

A bridge loan works by using the equity in your current home to help finance the purchase of a new one before your existing property is sold. It’s a short-term loan usually lasting six to twelve months that’s secured by your current home, which serves as collateral. This means if you default, the lender could foreclose on that property. While repayment terms vary by lender, most bridge loans are paid off once your current home sells, though some require interest-only payments during the loan period. Because not all lenders offer bridge loans and those who do may require you to also finance your new home with them, options can be limited. Bridge loans typically come with higher interest rates and fees than traditional mortgages, so they’re best suited for borrowers who need quick access to funds and have a clear exit strategy.

When Does a Bridge Loan Make Sense?

Bridge loans are powerful tools but only if you have a clear exit strategy. Talk to a broker (like us!) before making a move.

Bridge Loans vs. Home Equity Loans: What’s the Difference?

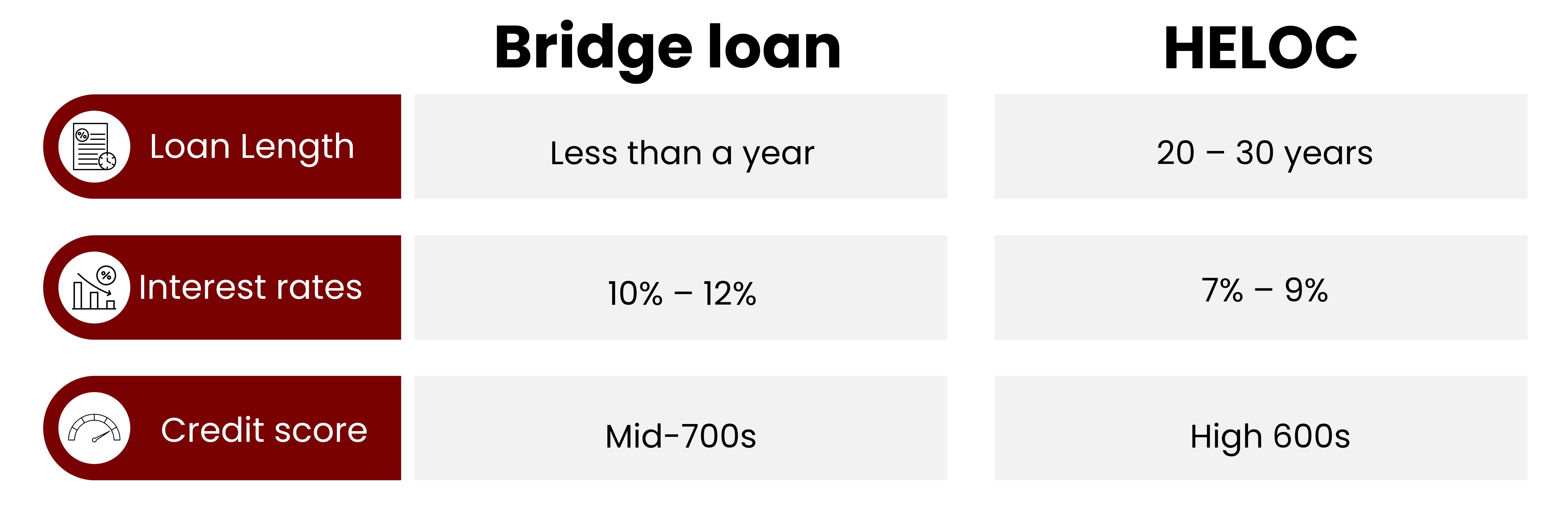

Bridge loans and home equity lines of credit (HELOCs) are both ways to access your home’s equity, but they serve different purposes and function very differently.

A bridge loan is a short-term loan—typically less than a year—used to “bridge the gap” between buying a new home and selling your current one. It’s designed for situations where you need fast access to funds, such as making a non-contingent offer in a competitive market. The loan is usually secured by your current home and paid off once that home sells or when you secure long-term financing. Because of the short term and higher risk to lenders, bridge loans generally come with higher interest rates and stricter credit requirements.

On the other hand, a HELOC is a revolving line of credit that allows you to borrow against the equity in your home over a much longer period—often 20 to 30 years. It starts with a draw period where you can borrow and repay as needed, similar to a credit card. During this time, you typically only pay interest. After the draw period ends, you enter a repayment phase where both principal and interest must be paid. HELOCs tend to have lower interest rates than bridge loans but are less suitable for urgent, short-term needs.

In summary, bridge loans are best for short-term, time-sensitive purchases, while HELOCs are better suited for longer-term borrowing and ongoing access to funds.

Who Qualifies for a Bridge Loan?

Bridge loans are best suited for financially strong homeowners who need access to equity in their current home before it’s sold. These loans are short-term (typically 6–12 months), interest-only, and come with higher rates usually between 8.5% and 12%. Because of the risk involved, qualifying can be more difficult than a traditional mortgage. Here’s what most lenders look for:

Common Qualification Requirements:

● Minimum Equity: At least 20% equity in your current home (most lenders cap loans at 75–80% loan-to-value).

● Credit Score: A credit score of 680 or higher is often required. Some lenders may ask for 740+.

● Debt-to-Income (DTI) Ratio: Ideally below 50%, but lower is preferred to show you can manage multiple loans.

● Strong Financials: You must show the ability to carry three obligations at once:

● Your existing mortgage

● Your new home’s mortgage

● The bridge loan payment (even if it’s interest-only or deferred)

● Income Stability: Proof of consistent and reliable income.

● Clear Exit Strategy: A realistic plan to sell your current home within 6–12 months.

Additional Considerations:

● Higher Interest Rates: Expect rates around 8.5%–10.5%, with no principal payments during the term.

● Short-Term Nature: These loans typically “balloon” (must be paid off in full) within 6–12 months.

● Lump Sum Only: Unlike HELOCs, you can’t re-borrow once paid down. It‘s a one-time draw loan.

● Use of Funds: Often used to cover the down payment or closing costs on your next home.

Before applying, speak with a loan officer to make sure you meet the criteria and can handle the financial risks involved if your current home takes longer than expected to sell.

What to Consider Before Getting a Bridge Loan

Before moving forward with a bridge loan, it’s essential to fully understand both the financial commitment and the potential risks involved. Like any major financing decision, taking the time to do your homework and thoroughly review the terms can protect you from unexpected setbacks.

Upfront Costs

Bridge loans often come with notable upfront expenses, similar to traditional mortgages. These may include closing costs, origination fees, and potentially an appraisal fee. These charges can add up quickly—sometimes amounting to several thousand dollars—so it’s important to factor them into your overall budget.

Limited Buyer Protection

Another critical consideration is the lack of protection if your current home doesn’t sell as expected. Because bridge loans are secured by your existing property, the lender has the right to foreclose if payments aren’t made. This makes it especially important to read the loan terms carefully and understand the risks. Ask yourself: How long could you manage without selling your current home? Would you be financially stretched if the sale were delayed? Doing research on your local housing market and average selling times can give you a clearer picture of your risk exposure and help prevent overextension.

Bridge Loan Alternatives

A bridge loan isn’t your only option if you need access to quick capital during a transition between homes. Several alternative financing methods can help you bridge the gap—often with lower costs or longer repayment terms.

Home Equity Loan

A home equity loan lets you borrow a lump sum against the equity in your current home. It’s typically secured by your property and offers fixed interest rates over a longer term—usually 10 to 20 years. While often more affordable than a bridge loan, this option still means managing two mortgages if your current home doesn’t sell right away. It’s a better fit if you plan to retain your existing property for some time.

Home Equity Line of Credit (HELOC)

A HELOC is a revolving line of credit secured by your home, functioning as a second mortgage. Compared to bridge loans, HELOCs often come with lower interest rates, reduced closing costs, and greater repayment flexibility. Funds can be drawn as needed—ideal for home improvements or other expenses. However, some HELOCs may include prepayment penalties, so review terms carefully.

80-10-10 Loan

An 80-10-10 loan structure allows you to avoid private mortgage insurance (PMI) by splitting your financing into three parts: 80% first mortgage, 10% second mortgage, and a 10% down payment. This setup can be useful if you lack a full 20% down but want to sidestep PMI. Once your current home sells, you can use the proceeds to pay off the second mortgage.

Personal Loan

If you have strong credit, steady income, and a manageable debt load, a personal loan may be a viable short-term solution. These loans can be either unsecured or backed by collateral, and are typically best for borrowers who don’t want to tie financing to their property. Loan terms and interest rates will vary depending on the lender and your financial profile.

Is a Bridge Loan Right for You?

A bridge loan can be a helpful short-term solution if you‘re planning to buy a new home before selling your current one. Here at Mission San Jose Mortgage, we are partnered with several lenders who offer bridge loan options. Based on your unique scenario, we’ll compare rates and terms across lenders to help you find the most suitable fit. While bridge loans offer flexibility, they also come with higher interest rates and the risk of carrying two mortgages if your current home doesn’t sell quickly. If a bridge loan isn’t the best match, we’ll help you explore other alternatives like HELOCs or home equity loans tailored to your needs.